Restaurant meal delivery in the U.S. hit a key milestone before the holidays, as 50 percent of American consumers have now ordered from one of the major meal delivery services, up from 44 percent a year ago, according to the latest figures from Bloomberg Second Measure.

As part of its latest analysis of millions of debit and credit card purchases, Bloomberg Second Measure’s latest delivery update also showed that, in November 2021, sales for meal delivery services collectively grew 13 percent compared to the previous year.

As part of its latest analysis of millions of debit and credit card purchases, Bloomberg Second Measure’s latest delivery update also showed that, in November 2021, sales for meal delivery services collectively grew 13 percent compared to the previous year.

Recapping significant industry milestones since the dawn of the COVID-19 era, the study reiterated DoorDash’s IPO in late 2020, Uber acquiring Postmates in November 2020, Uber diversifying its grocery offering, acquiring alcohol delivery company Drizly and partnering with Costco on same-day delivery.

More recently, Grubhub, which was once the U.S. meal delivery market share leader, was acquired by Europe’s Just Eat Takeaway.com, which was another mile-marker in a two-year period marked by mergers, acquisitions, mega-partnerships and new entrants, including from rapid grocery delivery providers.

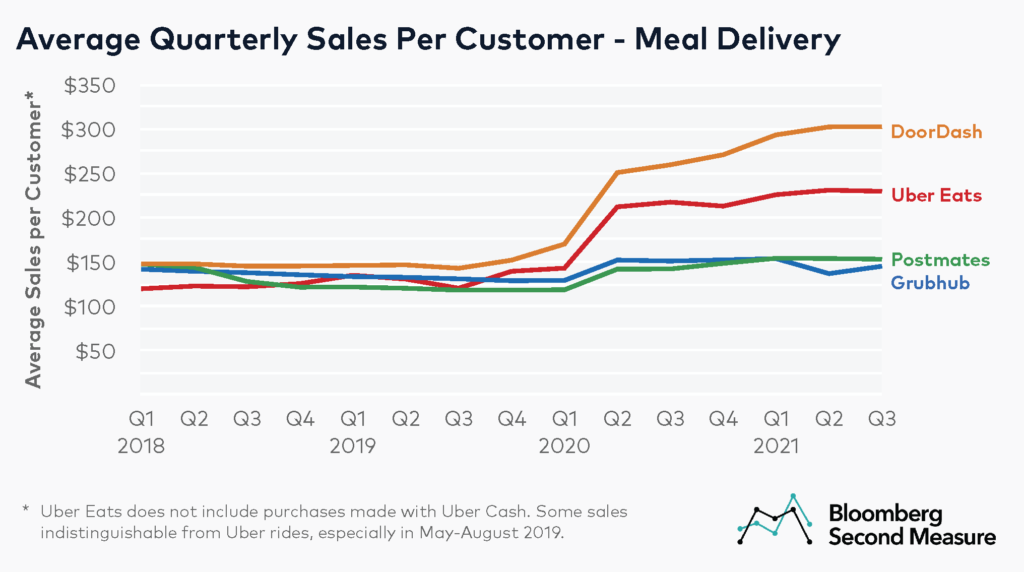

Bloomberg’s numbers also show that average sales per customer are on the rise at meal delivery companies, most notably DoorDash and Uber Eats.

“The average sales per customer has increased for these companies during the pandemic,” the report read. “DoorDash and Uber Eats have seen the most growth in average sales per customer over the past two years. At DoorDash, the average sales per customer in the third quarter of 2021 was 112 percent higher than the third quarter of 2021.”

That figure was lower, up 91 percent, at Uber Eats. The study also reported that DoorDash customers spent an average of $302 per customer during the third quarter of 021, above Uber Eats, which was second highest with an average of $229. Grubhub users spent an average of $153, and Postmates customers spent an average of $145.

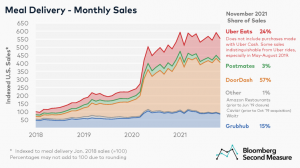

Overall U.S. delivery market share has remained relatively stable, with Postmates and Grubhub continuing to lose incremental amounts of share, while Uber Eats remains in second place, and DoorDash remains solidly dominant, with approximately 57 percent of the delivery market in November. Uber Eats has 24 percent, Grubhub has 15 percent, and Postmates still captures 3 percent of the delivery market—with Waitr at approximately 1 percent.

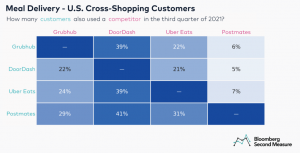

Even as these market share figures solidify, fewer customers are remaining loyal to a single meal delivery service, according to the study. Back in late 2019, 60 percent of Grubhub customers didn’t use other meal delivery services, but that has fallen to 48 percent two years later. Sixty-one percent of DoorDash customers use it exclusively, compared with 46 percent of Uber Eats customers.

Even as these market share figures solidify, fewer customers are remaining loyal to a single meal delivery service, according to the study. Back in late 2019, 60 percent of Grubhub customers didn’t use other meal delivery services, but that has fallen to 48 percent two years later. Sixty-one percent of DoorDash customers use it exclusively, compared with 46 percent of Uber Eats customers.

The report noted that all of the services have a lower percentage of exclusive customers than they did two years ago. Interestingly, with DoorDash being so dominant, it’s the provider most likely to nab customers from its competitors, with approximately 40 percent of each company’s diners also ordering from DoorDash during the third quarter of 2021.

“As more restaurants form exclusively delivery partnerships, more diners are going to have to hop between apps to cover all their favorite takeout spots,” Bloomberg Second Measure concluded. “The least loyal customers, it seems, will also be the most well fed.

Click HERE to check out the full report.