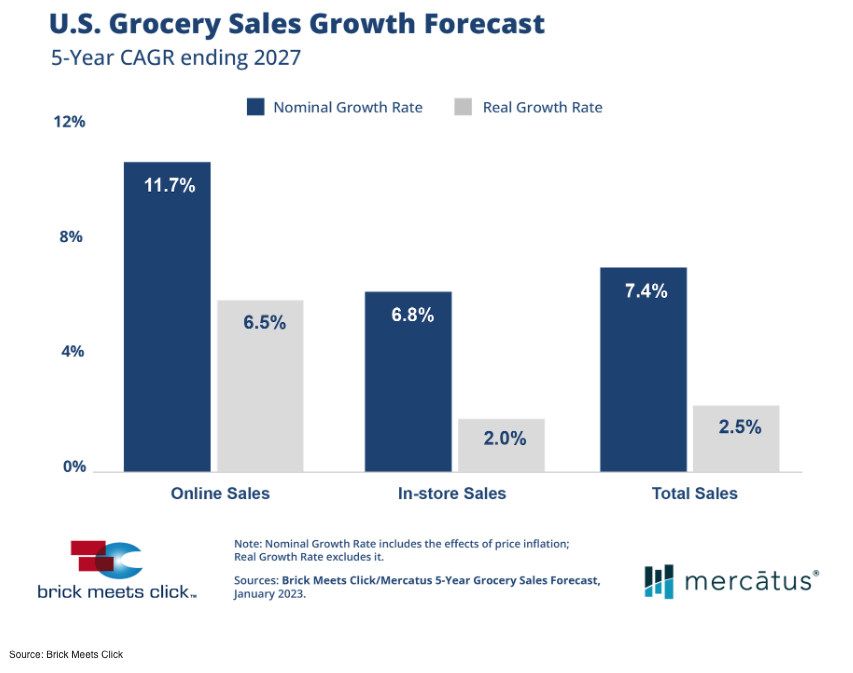

The forecast estimates U.S. online grocery sales to grow 11.7 percent through 2027 and increase the share of overall e-grocery spending from 11.2 percent in 2022 to 13.6 percent.

“Now more than ever, grocers need a grounded view of the future of the market, while simultaneously strengthening the customer experience to protect their base business and improving the profitability of this higher cost-to-serve mode of shopping,” said David Bishop, partner at Brick Meets Click.

Pickup drives growth

One way grocers could achieve this is by investing in pickup services, as the forecast projects sales to comprise more than half of all online grocery sales by 2027—advancing from 45.4 percent of the market to 50.3 percent.

Mirroring what’s happening in restaurants, Brick Meets Click projects pickup sales to grow 13.6 percent in five years, compared to 10.8 percent for delivery (first or third-party) and 8 percent for ship-to-home (FedEx, UPS).

The advisory firm expects pickup to reign over delivery and ship-to-home due to the anticipated growth of market availability—as many U.S. grocery retailers are continuing to expand pickup services throughout stores.

For delivery, the firm sees the segment as saturated, noting that consumers have multiple home delivery options from various retailers. Delivery is also more likely to be impacted by consumers financial and health concerns over pickup.

To work towards profit gains in the next five years President and CEO of Mercatus, Sylvain Perrier, advises grocers to know their customers and use insight to “deliver a more personalized brand experience that is consistent and frictionless.”

“Take steps to improve margins using simple tactics like offering lower-cost pickup services, engaging with multiple third-party delivery providers and leveraging first-party retail media to offset the cost to serve online customers,” Perrier stated.

Demand for online grocery has been driven partially by health concerns, which Brick Meets Click does not expect to subside soon. The forecast sites user concerns about the flu or COVID affecting their shopping decisions. Health concerns motivate about 10 percent of online grocery monthly users, according to the report.

Spending increase to drive overall sales

The forecast projects combined in-store and online grocery sales to increase 2.5 percent, including inflation, through 2027, driven by a 1.7 percent household spending increase and 0.8 percent boost in the number of households. However, the forecast states an aging population and declining household size weigh down those figures.

The firm also estimates grocery-related inflation to simmer over the next five years, dropping from 10.9 percent in 2022 to 2.8 percent in 2027. That inflation will drive almost three-quarters of estimated in-store sales gains but is expected to account for less than half of online sales gains.