As third-party ordering channels continue to take a significant revenue chunk from restaurants, San Francisco-based startup Loop aims to be the “co-pilot” for operators by simplifying the complexity of delivery data and assisting in deploying profitable off-premises strategies.

Loop is a delivery intelligence platform that automates back-end restaurant operations, utilizing artificial intelligence, and assisting operators in finding the right product-market fit.

“The core of all of this is fundamentally financial transparency, and the ability for them [restauranters] to reconcile and get a strong grasp of how they’re doing on the delivery front and make sure that they run delivery profitably and sustainably,” said Loop co-founder Anand Karthik Tumuluru.

With a restaurant entrepreneurial background and a former career as a software engineer at Uber, Tumuluru saw firsthand the benefits in leveraging third-party delivery data to manage errors and boost revenue.

Loop co-founders Vinod Pachipulusu, Anand Karthik Tumuluru, and Sundar Annamalai.

Leaving their giant tech company jobs behind, Tumuluru and co-founders Sundar Annamalai (also a former engineer at Uber) and Vinod Pachipulusu (a former engineer for Google) began by first talking to restaurants—finding that not only were many operators not seeing the opportunity surrounding third-party delivery data but that it was “an overwhelming burden” to decipher for most.

Wanting to simplify data management and understanding for restaurants, the trio launched Loop in 2022, equipped with an array of multi-modular compound products that automatically address several challenges faced in handling delivery today.

Addressing back-end delivery challenges

The company’s flagship product handles reconciliation of third-party delivery to provide a detailed breakdown of a restaurant’s financial data that analyzes transactions and categorizes expenses, to offer “thorough visibility into your marketing spend, commissions, taxes, and your chargebacks” to make sure “you’ve run a tight ship with all of these items,” said Tumuluru.

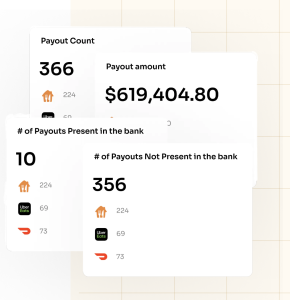

The reconciliation process compares in-store, POS sales to third-party platform sales, third-party sales versus payout, and payouts versus bank records.

On the commission side of things, Tumuluru says the tool can help restaurants determine commission splits and decisions surrounding third-party delivery exclusivity or whether or not to partner with all of the major third-party delivery providers.

For chargebacks, the feature can help determine which are disputable, such as missing item chargebacks, wrong order issues or friendly fraud.

“Chargeback resolution is an extremely complex and time-consuming task to do manually. With most business owners spending more time fighting chargebacks then analyzing the data and identifying trends,” the company wrote.

Loop provides automated journal entries for delivery revenue.

Along with the reconciliation features, Loop provides automated bookkeeping, to automatically close books for restaurants on a monthly basis, saving hundreds of hours.

Additionally, under Loop’s product suite umbrella, is a real-time dashboard and lost sales tracker. This enables restaurants to toggle stores on or off and track past uptime and downtime.

Loop also offers marketing solutions, providing deep data analytics that give insight into campaign performance, customer lifetime value (CLTV) & retention to maximize ROI. As well as store performance tracking, via weekly reports to “understand performance from a location and shift perspective.” This includes week-to-week reports to access downtime, high chargebacks and bad reviews that could have lasting impacts on financials and identify issues before they become trends.

The company also has a Chat GPT-4 feature, that lets restaurants SMS questions regarding their backend operations.

Loop is currently integrated with DoorDash, Uber Eats, Grubhub, Postmates and Olo. Since its inception, the company has continued to grow and scale. It is now serving more than 4,000 locations, including a recent partnership with Craveworthy Brands.

“The time has come for restaurants to take delivery and third-party delivery seriously, and run it with the same operational rigor as they would do for the rest of their business,” said Tumuluru.

“With third-party providers, restaurant operators have this unknown large revenue chunk that we don’t understand, and it’s important to look at it, at the least, and optimize line items away one by one to ensure that it’s profitable and sustainable.”