Delivery consumers aren’t the thriftiest folks out there, as survey after survey says they see the cost of convenience as worth the price. As these delivery networks attempt to make a profit and the economy takes a turn, fees could become a more impactful piece of the delivery puzzle.

In a new round of checks on delivery fees by Kinetic 12, a management consultancy focused on the foodservice industry, the company found that the price of delivery can vary significantly from company to company, and the fees are generally going up.

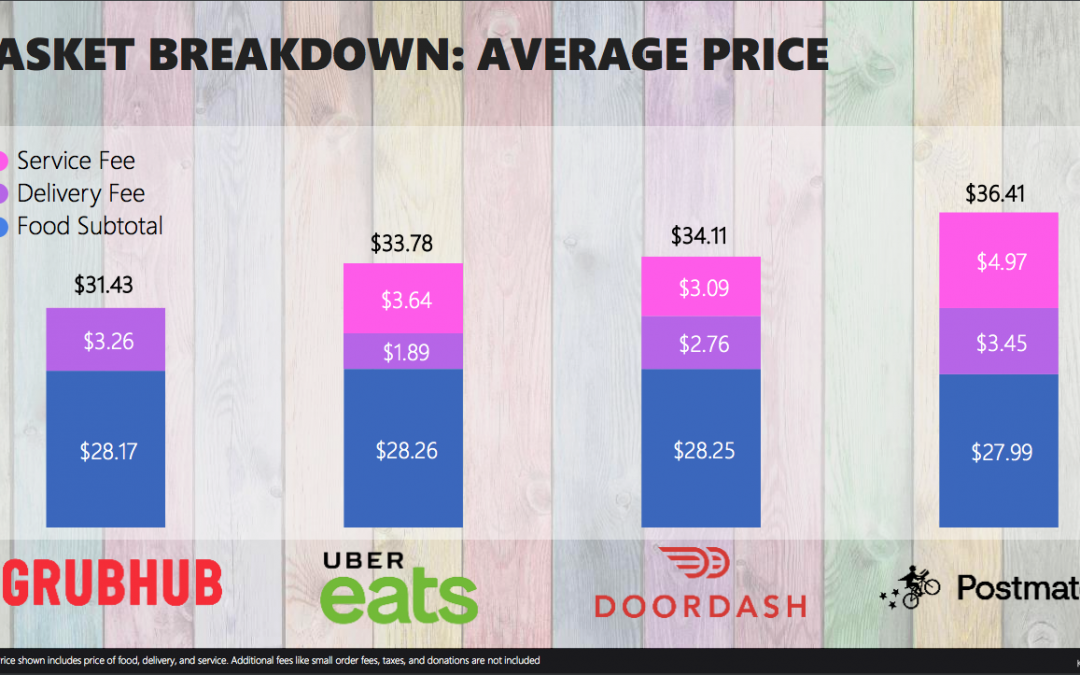

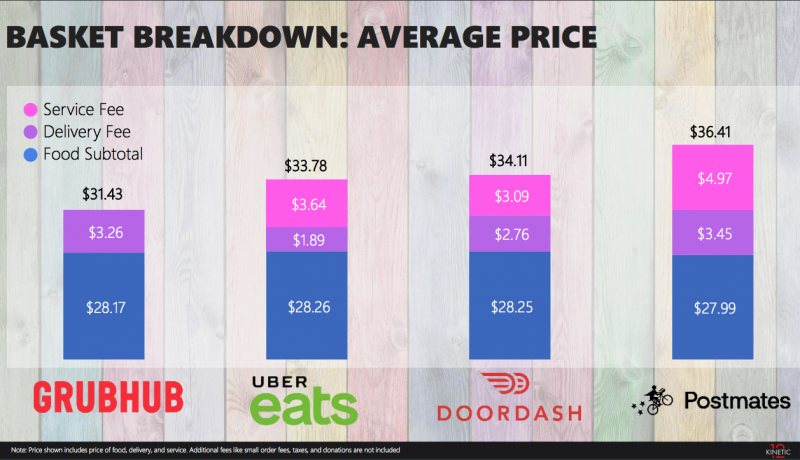

As seen below, Grubhub comes in at the lowest overall cost; Uber Eats ticks up with a service fee on top of the delivery fee, as does DoorDash; and finally there’s Postmates, which has the highest average fee at $8.42.

Kinetic 12 did the research by ordering 250 deliveries from across 50 different markets. The orders ranged from $15 to $50, but landed at the remarkably close range of about $28. Kinetic 12 also ensured that each of the orders were identical from market to market. One significant point is that these were the fees charged without any promotions.

In all, it found that Grubhub had the most modest fees overall because, unlike its peers, the company doesn’t charge an additional service fee.

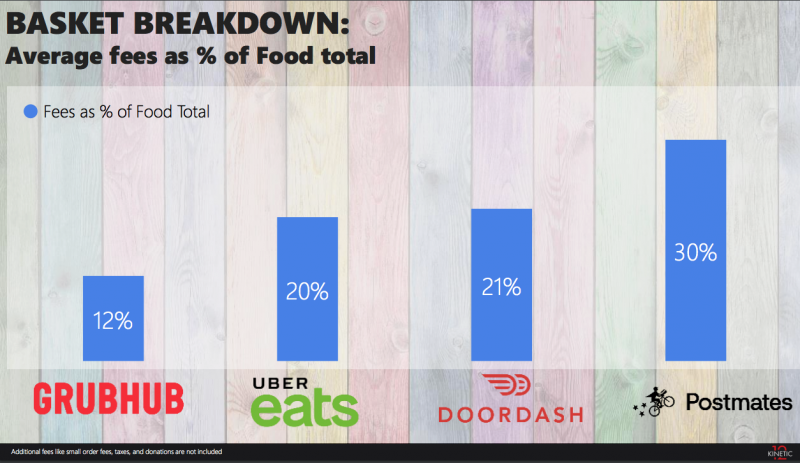

In Food On Demand research carried out by SeeLevel HX, we found consumers are willing to pay for convenience, but there is a limit. Respondents said a low fee of $1.75 actually raised red flags because it was too cheap; $3.60 was a “great deal;” at $6 things started to get expensive; and $8 was just too expensive. Of course, Postmates at above $8 generally caters to wealthier, western states where that might not be as big of an issue compared to the general population.

Fees have gone up significantly since that research was conducted in 2018. In that research, Uber Eats charged an average of $4.09 and DoorDash charged $4.32 all in. Grubhub is the only company to have kept the fee more modest and hasn’t added an additional service fee on top of a delivery fee.

Even with those extra fees, the prices are still within a likely intentional $5 range as the delivery networks seek profits but continue to seriously compete for market share. When looking at the fees as a percentage of the total sale, however, the numbers become more varied. Fees charged by Postmates, on average, accounted for 30 percent of the actual food being delivered. That might be fine for a one-off night, but as these companies push for more regular usage, it might not make sense.

Overall, Elevate 12 gives us a nice look at the fees, and if researchers know about it, so do savvy delivery consumers. The typical diner has three different apps on their phone, and despite early assumptions of “stickiness” for their chosen app, it’s clear they are shopping around more as new networks come to their market or promotions give them a reason to order.