Presto Automation, a provider of voice AI technology for the restaurant industry, has sold its assets to a venture capital group led by Remus Capital.

The deal closed in December and includes an $18 million capital inclusion to support the company’s growth and transition.

A group of investors including Remus Capital, Link Ventures, and Metropolitan Partners Group acquired Presto’s assets.

The sale follows Presto’s default on a loan from Metropolitan Partners, which led to a foreclosure and the eventual auction of the company’s assets.

Presto will be taken private after a brief period as a public company, following its 2022 SPAC merger.

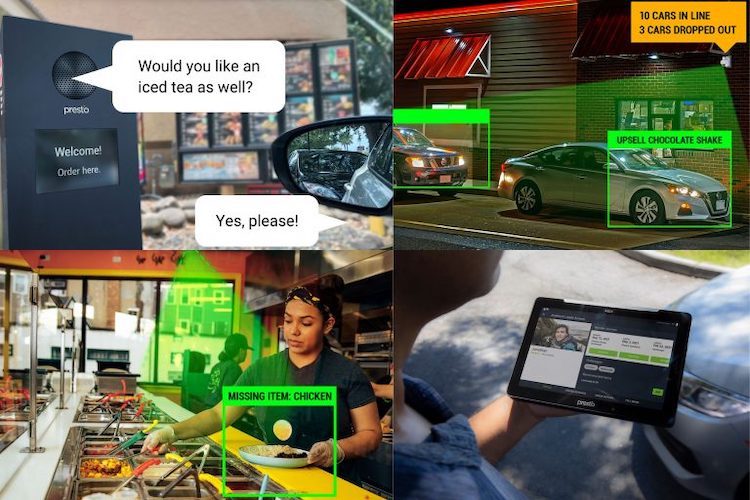

The company, now rebranded as Presto Phoenix, will focus exclusively on its Voice AI technology for restaurant drive-thrus.

The system is designed to aid restaurant staff by automating the order taking and consistently upselling, often resulting in larger check sizes. The tech is live at select Carl’s Jr/Hardee’s and Taco John’s locations.

“We are excited to begin this new chapter,” said Gee Lefevre, CEO of Presto Phoenix. “The transition to a private company with a sustainable capital structure, combined with this influx of new capital, gives us the flexibility to accelerate our growth.”

Lefevre added, “We intend to become the leader in the QSR Voice AI market.”

Voice AI is becoming increasingly prevalent in the QSR space, particularly in automating drive-thru and phone ordering. Several companies compete for restaurant customers, which has led to partnerships, including ConverseNow acquiring Valyant AI, Checkmate acquiring VoiceBite, and SoundHound joining forces with Allset.