As the COVID-19 pandemic continues to shake the restaurant industry, industry data is giving some clarity to just how bad sales are. Data from various outlets shows an industry in free fall, and while sobering, a clear view is important so the Food On Demand world can respond appropriately.

Stock analysis firm Cowen put out a note exploring some point-of-sale (POS) data from WhatsBusy, a data tracking firm that partners with POS providers. Cowen’s Andrew Charles and George Mihalos had a conversation with founder Jordan Thaeler to pour over the 50,000 or so restaurants in his data.

The data therein confirms what we’ve all been hearing on conference calls and out in the broader media: restaurant traffic has plummeted. Fine dining has been hit the hardest, with sales cratering 90 percent or more as scores of upscale restaurants simply close doors to wait it out instead of muscling through with delivery or takeout.

It makes a lot of sense for some of these restaurants that provide high-touch service and elegant settings as much as delicious food. There aren’t all that many people who will pay for a $50 cut of lamb or elegant piece of fish out of a takeout container, and because these restaurants typically don’t have a freezer full of inventory, mothballing a fine-dining restaurant isn’t quite as painful as long as it can bring staff back when this is all over.

Casual dining chains also fared poorly. Sales in WhatsBusy data dropped 75 percent, buoyed by the comparatively small amount of takeout and delivery sales. Some casual diners have even reported single-digit increases in off-premises sales as people order more and new users try online ordering for the first time. Many brands have also found a nice niche through family meals for consumers looking for a break from cooking.

The fast-casual segment is down 65 percent, according to the data. QSR is down 50 percent, “the latter category holding up the best on a relative basis, aided by an existing drive-thru infrastructure” wrote Charles and team. “We broadly expect quick-service comps in our coverage universe to decline 20 percent.”

Wendy’s noted that sales in the week of March 22 had declined 20 percent, so some QSR restaurants are faring better than others.

With some light at the end of the tunnel, Cowen’s note ended with a factoid from Thaeler saying that partners in Asia did bounce back quickly. So far, China has already recaptured 65 to 75 percent of pre-COVID sales.

“Mr. Thaeler highlighted data from partners in Asia that indicates a V-shaped recovery in China as a potential analog for the U.S.,” wrote Charles and team. “Though importantly the country practiced more restrictive social distancing practices than the U.S. has so far implemented.”

Could this be the Traffic Bottom?

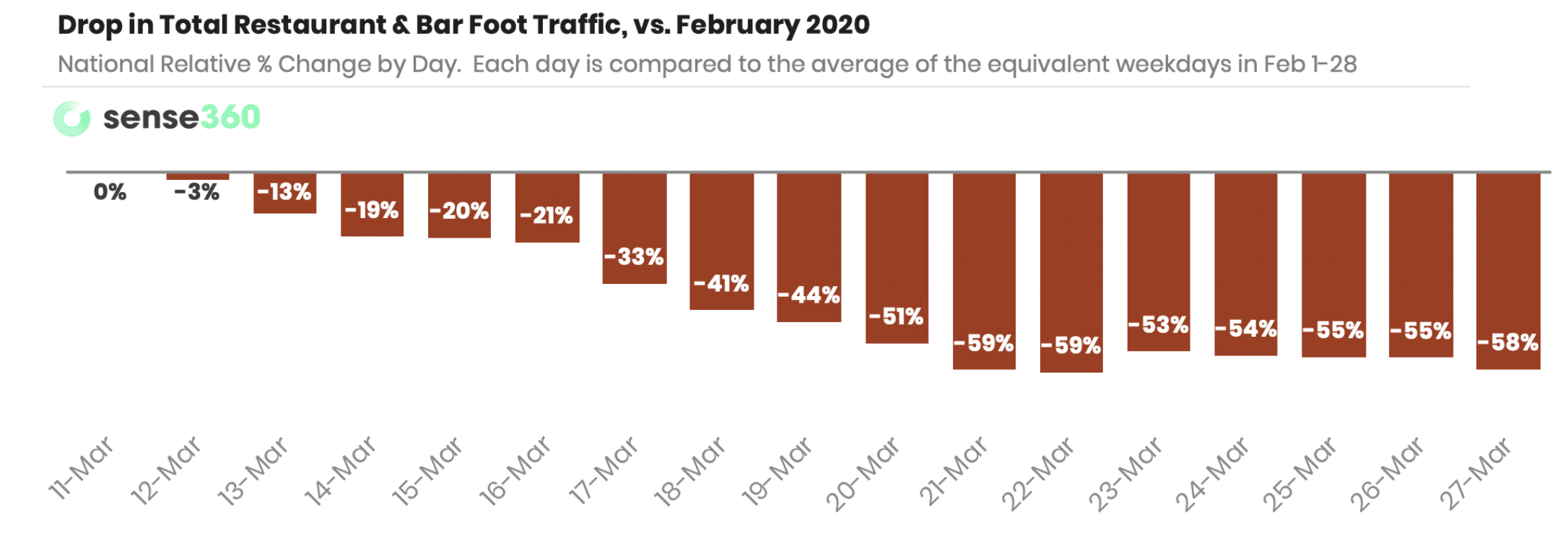

Sense360 released a new batch of traffic data, and it held some potentially positive news.

“The steep decline in total foot traffic is leveling off…” wrote Olivia Watson, who has been blogging about the daily data updates for the company. “But possibly hasn’t stabilized yet.”

As of March 27, traffic fell 58 percent across the restaurant industry in data mostly gleaned from cell phone movements. The traffic has held relatively steady through the week suggesting that maybe this is as bad as it gets. Of course, it is possible that may be overly optimistic.

“Although it appears that restaurant foot traffic is stabilizing compared to February, this doesn’t mean year-over-year comps are stabilizing. Normally, there is annual seasonality at play in which traffic normally grows in March. So, even though the pattern is holding somewhat constant, in a normal environment, we would expect that traffic in March should steadily be growing over time,” wrote Watson.

Traffic fell the furthest in the last week in the East South Central region, that includes Mississippi, Alabama, Tennessee and Kentucky. Those states saw a drastic rise in COVID-19 cases in the recent week, and Mississippi Governor Tate Reeves just issued a shelter-in-place order. All of the states faced criticism over late responses to the pandemic and have taken greater measures to “bend the curve.”

Traffic actually rebounded in the Mid-Atlantic and New England regions, but both saw extreme and early traffic declines as they were so close to hotspots of New York and took active measures early.