McKinsey put out a report advising the restaurant industry how it might survive or thrive in the “next normal.” Noting that the pandemic has most severely impacted restaurants in urban areas, the authors outlined nine possible scenarios for the restaurant sector’s recovery, which included anonymous input from 2,000 global executives on which scenarios they feel are most likely to unfold.

First, the bad news. Stacey Haas, John Moran, Eric Kuehl and Kuma Venkataraman, authors of “How restaurants can thrive in the next normal,” outlined that sales in the fine-dining and casual-dining segments are down anywhere from 70 to 80 percent. Coffee has also seen outsized negative impacts, with sales down an average of 60 to 70 percent. Sales in the fast-casual segment have declined 45 to 55 percent, with quick-service brands down 25 to 35 percent. The only bright spot is the pizza category, which is seeing sales anywhere from flat to up 5 percent, depending on the brand.

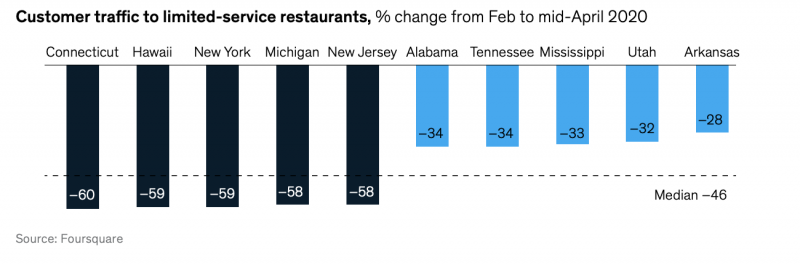

The authors called out brands that were especially reliant on lunch and breakfast traffic as being heavily impacted. Urban states were also impacted heavily, with the most populous states being hit hardest. Dense, urban areas are generally more observant of their stricter shelter-in-place rules than less-dense areas. Logically, businesses in viral hotspots like New York and New Jersey are especially hurting as people there have seen dramatic impacts from the pandemic in both sickness and death. The authors point to Foursquare data to show that those dense areas saw much steeper traffic declines. As seen in the chart below, dense areas saw almost twice the traffic hit compared to more-rural states.

The brands least affected, as other reports have shown, were restaurants with more off-premises sales prior to the pandemic and those with the strongest digital operations.

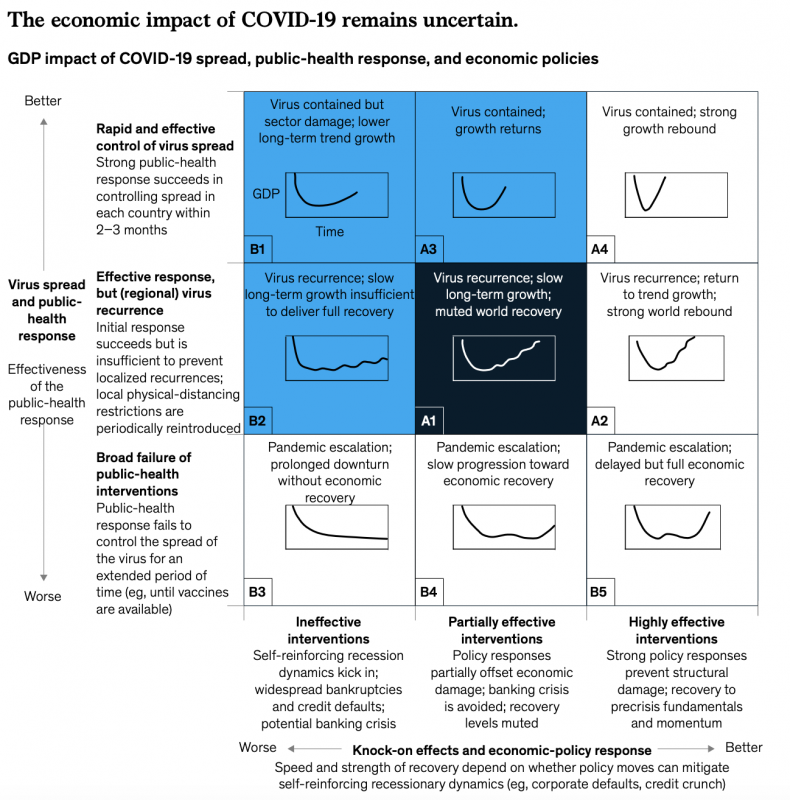

But the meat of the report showed nine potential scenarios for the industry’s recovery, depending on how the pandemic plays out and how effective the policy responses could be.

“As of this writing, the likeliest scenarios appear to be A1 and A3. While both assume partial to high effectiveness of economic-policy interventions, scenario A1 assumes resurgence of the virus across regions, whereas A3—the more optimistic of the two—assumes rapid and effective control of virus spread,” report said.

Authors surveyed 2,000 global executives, and A1 was the most popular response with one-third of respondents saying it was most likely, A3 was second with 16 percent of the vote, according to authors. As they note, “these are grim projections” and small brands and independent operators are especially vulnerable because they lack the financial means to endure prolonged hardship. In all, the authors estimated that if the virus recurs, it would take pizza until the fourth quarter of this year to return to pre-crisis levels, but fine dining would suffer reduced sales until the second quarter of 2024. Broadly, they estimated that if the virus is contained, sales would remain reduced between 15 and 25 percent through the first quarter of 2021 and reduced by 25 to 35 percent if the virus recurs in the fall.

“We estimate that, of the 650,000-plus U.S. restaurant locations that were in business in 2019, approximately one in five—or more than 130,000— will be permanently shuttered by next year,” they reported.

That’s an exceptionally grim outlook, but one echoed by other analysts.

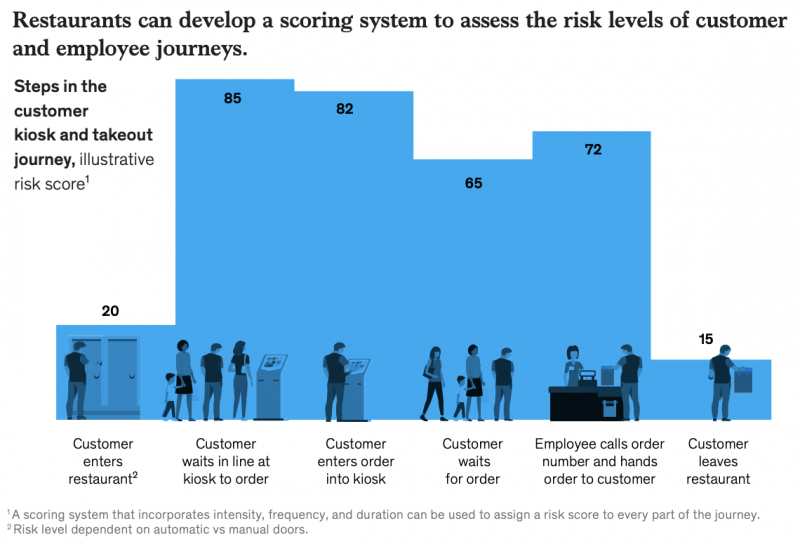

The authors did, however, share some ideas on how to survive in an era of low traffic and consumer reticence or financial ability to return to restaurants. They advised rethinking restaurant design to remove as many interactions as possible and shorten essential interactions and executing on low-hanging fruit now and long-term solutions as possible. Interactions like standing in the line and ordering at a counter were highlighted in the following chart as key parts of the consumer experience that could be rethought.

Authors called out robots as a way to help with takeout orders, but, more realistically, things like low-cost Internet of Things (IoT) sensors to help measure traffic and predict demand scientifically or shelving for pickup orders could generate a real bang for the buck.

They also advised optimizing the footprint, suggesting large locations may have to close or be reworked as off-premises food factories and new locations may have to be smaller to maintain sales per square-foot. Optimizing, e.g., slashing, the menu has already been done in panic mode for many brands, but authors advised keeping close watch on trending items and changing to adapt to the remaining consumers coming in and ordering from home.

The researchers also gave a few tips to bring back customers in a “segmented approach” to marketing. They advised restaurant operators to digitize as much of the customer engagement as possible, with closer, relevant marketing to stay top of mind for the limited restaurant usage in the near term and reach out to different cohorts in different ways. For new pandemic-era customers, they advised operators to plug them into loyalty programs to maintain contact. For loyal members, it might be less about asking them to return but just keeping in touch about reopening and how the restaurant is maintaining safety. As operations return to some semblance of normal, loyalty-only offers and “just in time” offers could bring those customers back to their old buying habits. In general, with so much upheaval in the restaurant segment that will continue, the authors said it was important to broadly rethink marketing given the new restaurant landscape and also the new consumer mindset.

What does all this mean for the food-on-demand universe? In brief, a sudden acceleration of trends. Everything the McKinsey authors outlined was already happening slowly, but the pandemic put the proverbial pedal to the metal. For vendors, that means helping restaurants keep up and simply survive in the near term and, for restaurants, it means putting the old model in the drawer until this is all over and rethinking the business from the ground up.