As two off-premises giants have already demonstrated, whether it’s internal or third-party, delivery is the place to be during the volatile COVID-19 pandemic.

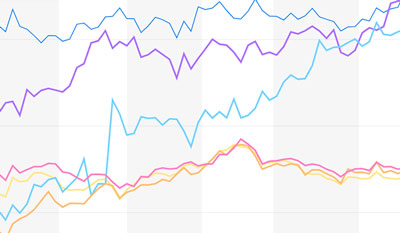

The two companies showed some exceptional results in their respective second-quarter earnings. Domino’s reported 16.1 percent same-store sales growth, while Wingstop reported a 31.9 percent jump in same-store sales. Compared to the backdrop of -18.7 percent same-store sales (as measured by Black Box Intelligence in June), that would be shocking if it weren’t just another quarter of wild diversion from the mean for these companies.

“The second quarter marked a rather unprecedented acceleration for food delivery in the U.S. and we were certainly no exception. Our 37th consecutive quarter and strongest in that nine-plus year run for same-store sales, with evidence of this tailwind in delivery,” said Domino’s CEO Ritch Allison in an earnings.

That’s basically the norm for Wingstop, too. Its second-quarter results mark 16 years of same-store sales growth “with a couple of recessions in there,” noted Wingstop CFO Michael Skipworth during the earnings call.

Domino’s has succeeded with value-forward pizza and targeting those weeknight lazy meals. Wingstop does it by pushing those indulgent occasions.

One key factor at both companies is a consistent focus on digital transactions. At Domino’s, digital transactions rose to 75 percent of sales for the quarter, ticking up to 80 percent at some points. That, Allison said, drives loyalty and gets consumers locked into the ease of app ordering and the one-to-one marketing via push notifications. As anyone with a Domino’s app knows, there is always a reason to get a $5.99 pizza.

Wingstop noted it hit 63.7 percent digital penetration. There’s the app, but also connections with scores of chat platforms, Facebook and chatbots giving customers multiple access points to the brand and delivery via its third-party partner DoorDash.

A free delivery offer at the start of the second quarter was very beneficial for ramping up the number of Wingstop users.

“The free promotion ended in April and still maintained really strong results,” Skipworth said. “As we gained a lot of customers, we are engaging them and watching their patterns, some of that is waiting for the next purchase cycle to see if they hit that milestone and potentially using our CRM to bring them back in.”

He said new customers and core customers are ordering more during the pandemic, and frequency is growing as the economy shakily gets back to some semblance of normal. Notably, smaller orders are increasing, whereas early in the pandemic, the company saw larger orders as folks pivoted to dinner traffic.

Investors have been flocking to both brands, with Wingstop reaching the 30-percent range of sales going into delivery, while Domino’s has taken a similar approach.

“We continue to believe the COVID comp uptick has a longer and larger tail than medium- to long-term expectations. Management highlighted relatively consistent trends through the end of Q2 even as dining rooms across the industry reopened,” wrote Wedbush stock analyst Nick Setyan in a research note exploring the Domino’s results.

As Domino’s CFO Jeff Lawrence said during its latest earnings call, it was a trend before, and it’s been accelerated—consumer shifts like that don’t just go away.

“You want to be in carryout; you want to be in delivery whether there’s a pandemic or not,” said Lawrence.