One of the biggest questions from restaurateurs is how the various third-party delivery providers stack up. According to new data from mystery shopping and survey firm SeeLevel HX, things are fairly even in an ever-changing segment.

In a research project sponsored Food On Demand, the study is the first of its kind to take a close look at the leaders in third-party delivery, with an army of 1,400 mystery shoppers across the country. SeeLevel also conducted a large consumer survey to see how users of third-party delivery engaged with those delivery providers.

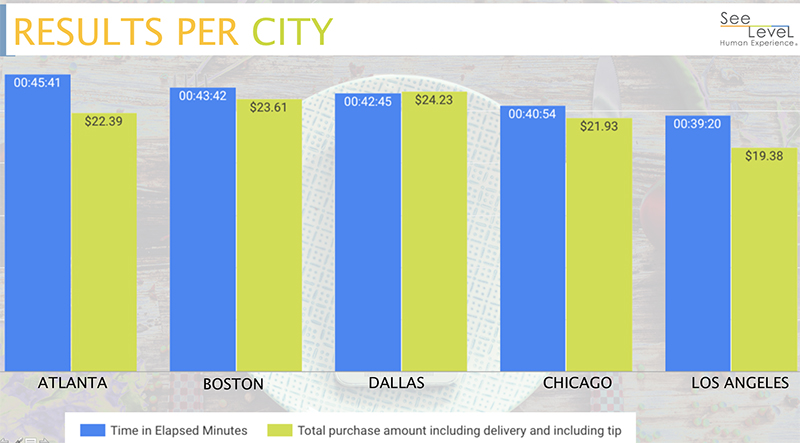

Mystery shoppers in Atlanta, Los Angeles, Chicago, Boston and Dallas were tasked to record delivery times, order accuracy and more than 20 other metrics around third-party delivery.

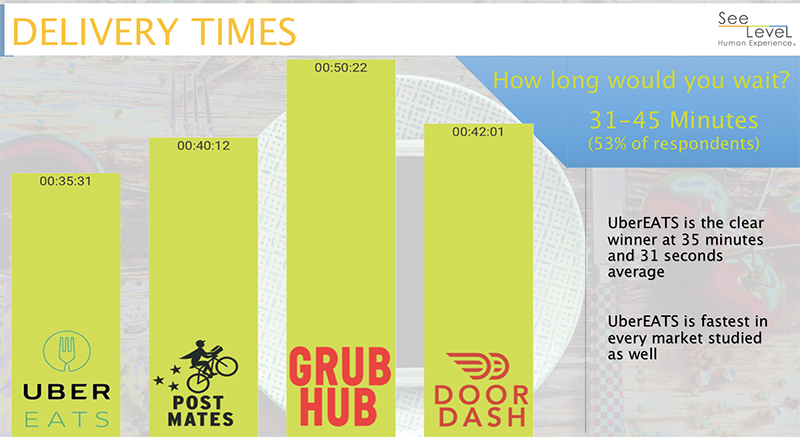

One big talking point is the speed of delivery. UberEATS was the fastest at 35:31 on average, followed by Postmates at 40:12, DoorDash at 41:01 and Grubhub at 50:22.

“I hadn’t seen the data before this morning, but it’s kind of fun to come in first on the speed metric,” said Bowie Cheung head of regional operations at UberEverything for U.S. and Canada during a session at the 2017 Restaurant Finance and Development (RFDC) conference.

SeeLevel asked consumers how long they were willing to wait, and more than half said they would wait up to 45 minutes, putting everyone but Grubhub solidly within consumer expectations on average.

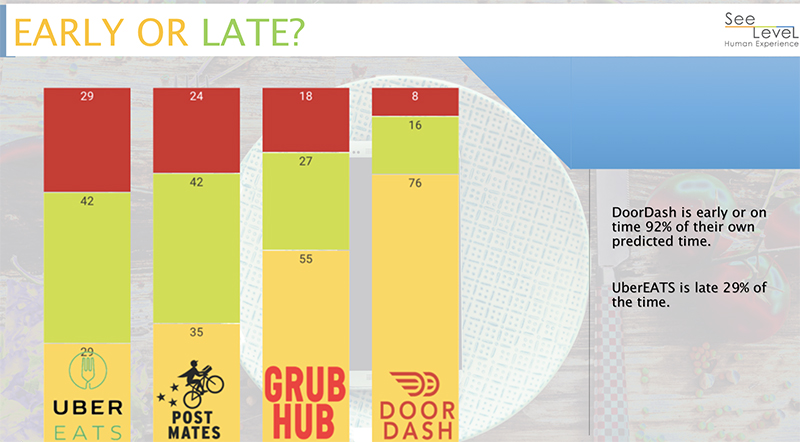

While UberEATS was the fastest, it also missed delivery time estimates more than anyone else.

“It appears that there is some different strategies going on, there’s some that estimate high and deliver in a much shorter time, and there’s some that try to estimate exactly when it will come,” said Lisa van Kesteren, CEO of SeeLevel HX during the session.

Cheung said for UberEATS, that metric showed how they were continuing to experiment.

“In a mature version of this world, because we’re all learning this, the green segment should be very large and should be the vast majority of the bar,” said Cheung about the graph (pictured above).

He said one factor was that restaurants could choose to delay order pickup times when the restaurant is very busy, after the estimates already have been relayed to the diner.

“That means the courier will pick up on time, but it’s not going to be perfect for the user experience because we told them it would be 30 minutes,” said Cheung. “I think we have to constantly work on the technology and the operational process to zero in on delivery times and deliver the right experience.”

Order times and ticket prices varied significantly from market to market. Atlanta had the longest average delivery times, across the board, orders took 45:41 to get to consumers. The fastest market, despite all the talk of traffic, was Los Angeles, orders there got to consumers just seconds shy of 40 minutes. The highest tickets were seen in Dallas where diners spent $24.23 on average.

Los Angeles also saw the lowest ticket prices at $19.38 on average. How exactly those numbers shook out is a bit of a mystery, but may speak to the different restaurant landscapes across the markets in the mystery-shopping project. It seems that L.A. consumers order things that are closer and given the stiff competition, prices there are somewhat cheaper. Dallas has seen a wave of growth, especially among high earners at major corporate headquarters; which may push that ticket price higher. And while traffic is bad in every major city, it’s pretty clear that Atlanta traffic is just awful.

“Regional strengths is not unusual in any company, particularly in a B2C environment because where you have to take into account regionalism, cityisms or townisms, all that makes a difference,” said van Kesteren.

Cheung said each market presents a completely different challenge.

“The demographics are surely a part of it, too. Florida, for example, is a state that we see a lot of multi-entrée orders; we see a lot of chains,” said Cheung. “But other differences that really matter: traffic patterns, the density of a city which impacts how fast your deliveries are, whether it’s a city with a lot of condos or apartments because that means some very different things for the courier.”

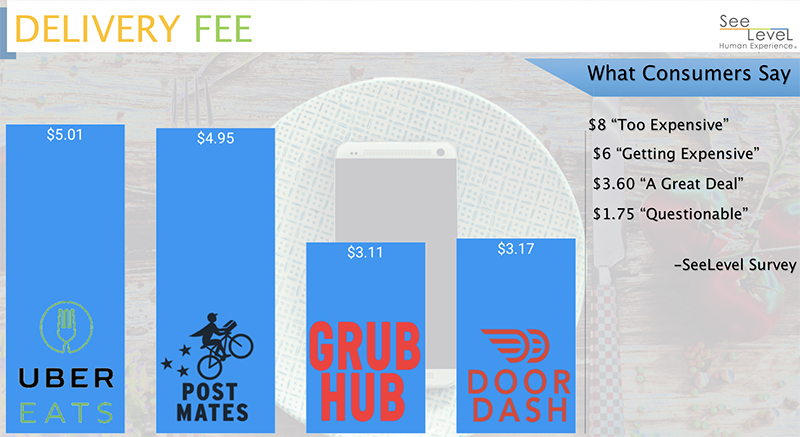

While Grubhub was slightly slower, with times driven up on average in tough traffic markets like Atlanta, it was one of the most cost-effective delivery providers. On average, Grubhub orders cost the least at $3.11, followed by DoorDash at $3.17, Postmates at $4.95 and UberEATS at $5.01.

In an exclusive data set for Food On Demand in the SeeLevel consumer survey, all of those prices were easy to pay. Consumers said that the $8 mark would be too expensive, $6 would be getting expensive but still doable and $3.60 is a “great deal.” No firm dipped below the $2 mark, where consumers surveyed said it would get questionable as far as quality.

And the chief question from restaurant operators is often, “How does this affect my restaurant?”

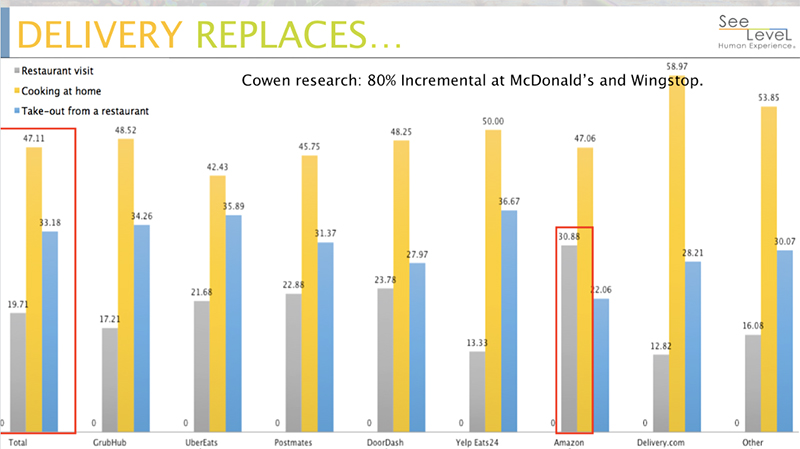

Other research from investment bank Cowen shows that delivery is largely incremental, and again, another Food On Demand exclusive data point from the SeeLevel survey shows that few at-home diners are replacing restaurant visits. Overall, 47 percent of diners said orders replaced cooking at home, 33 percent said it replaced take-out from a restaurant and just shy of 20 percent said it replaced a restaurant visit, meaning it’s 80 percent incremental.

“We consistently hear 70 to 80 percent range from folks that we partner with,” said Cheung.