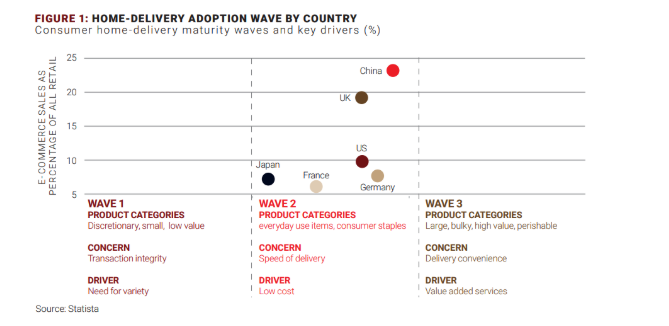

Home consumer delivery usage seems to be driven by available technology, but according to a model from research firm AlixPartners there are three phases that are largely pushed by consumer desires.

In its new survey, AlixPartners adds some context to what it sees as the three waves of ecommerce adoption and how consumers use services from retail to food. In brief, “Wave 1” is consumers’ desire for variety of goods and secure transactions; “Wave 2” is consumers desire for fast delivery and low or no-cost service fees; “Wave 3” is consumer desire for convenience, control and in-home service.

The survey posits that the U.S. went through Wave 1 in the 1990s through the late 2000s and is now in the midst of Wave 2, just behind Germany and right in line with the U.K. But it’s not just ecommerce volume, the U.K. has a large, dense population and thus a much higher ecommerce percentage, but U.K. consumers still operate in Wave 2 along with the U.S.

The drive for Wave 2 is low cost, and the free, fast delivery wars across the retail landscape are a symptom of consumer demand for everything from everyday items to consumer staples.

China skipped right over Wave 1, according to AlixPartners, with a surge of technology embraced by its burgeoning middle class. Now, it’s poised to be the first major economy in Wave 3, which is driven by value-added services and a stronger desire for convenience—even above delivery speed. It also means more Chinese consumers are ordering bulky items like furniture or appliances, and expensive or perishable items.

Of course, there are a lot of people ordering that way in the U.S. at present, but those ordering furniture or grocery delivery are still a very small portion of the American ecommerce pie. Just 23 percent of U.S. respondents said they planned to order restaurant food in the next month compared to 40 percent in China.

There are some lessons for companies looking to the inevitable third wave. China, at the cusp of that wave, values free delivery much less, instead looking for value-added services like installation or assembly at the time of delivery.

For the food world, that may take the form of someone to put the groceries away—not something many Americans would likely pay for now, but may when they’re comfortable enough with grocery delivery service to let them inside during work hours.

Already, U.S. consumers seem eager to pay for someone to install or assemble the furniture or appliances—51 percent said they would pay for someone to install a large appliance and 39 percent said they would pay someone to build their furniture.

See the full report here and more insights here at AlixPartners.