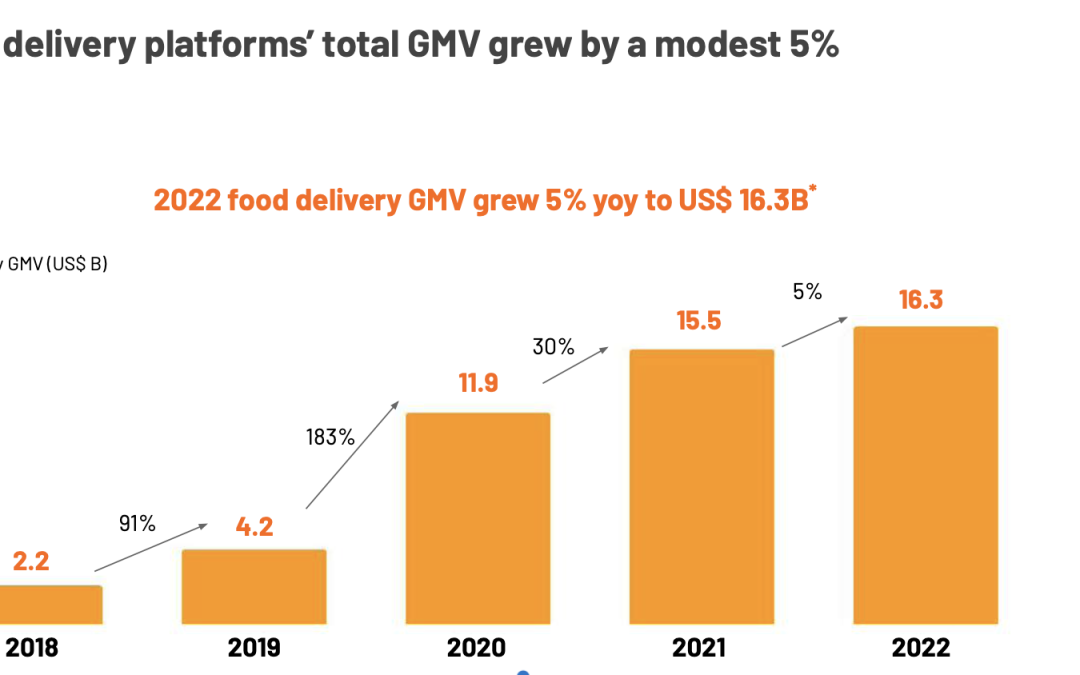

Food delivery growth in Southeast Asia appears to be normalizing to pre-pandemic levels, after two years of supercharged growth from the pandemic.

Online food delivery spending rose 5 percent to $16.3 billion in 2022, according to a report by venture builder Momentum Works. A significant drop compared to the 30 percent growth in 2021 and 183 percent growth in 2020.

Total Gross Merchandise (GMV) growth was driven by smaller markets in the Philippines, Malaysia and Vietnam, while the three largest markets, Indonesia, Thailand and Singapore, all shrunk in size.

The slowing growth could be attributed to a few factors, including the resumption of dining-in, reduction of government subsidies for deliveries, reopening of borders and further market rationalization. The rising interest rates also led to a difficult capital environment for tech firms, including major delivery platforms.

Singapore-based delivery app giant Grab, which operates in eight countries, led the revenue earnings, accounting for 54 percent, or $8.8 billion of Southeast Asia’s food delivery GMV in 2022—a 16 percent jump from 2021. Delivery company Foodpanda, which operates across Asia, contributed 19 percent at $3.1 billion while Gojek and Shopee maintained their previous year’s levels at $2 billion and $0.9 billion.

In addition, the report highlighted several trends:

Platforms are attempting to have more leverage on both the supply and demand of food services, as fragmented digitisation has led many platforms to attempt POS integration. The report notes that, to the frustration of merchants, it’s common in Southeast Asia for markets to juggle multiple POS devices, platforms and other digital solutions for managing orders from multiple channels.

The report also shows that platforms have stopped or scaled down dark stores and kitchens for groceries and food delivery. “There is barely any product market fit for the dark store model,” the report wrote.

Momentum Works expects this trend to continue in 2023, with Shopee’s plans to focus on e-commerce and Delivery Hero’s potential exit from some search-engine-advertising (SEA) markets.

Finally, The rising interest rates lead to a difficult capital environment for tech firms, including major food delivery platforms. As a result, companies are prioritizing profitability and exploring additional revenue streams such as advertising and subscription models.

Meanwhile, in the U.S. trends are similar among the online food delivery and grocery delivery market. The market also saw two years of unprecedented growth with the pandemic, met with a slowing in 2022 amid the reopening of in-person dining, and consumers looking to save money as uncertain macroeconomic conditions progress.

The U.S. online food delivery market size reached $26.1 billion in 2022. Looking forward analysts expect the market to reach $46.5 billion by 2028.