With 26 years in the restaurant tech space, OneDine founder and CEO Rom Krupp wants the industry to build a new foundation that doesn’t rest upon point-of-sale systems that he argues are fundamentally ill-suited to the job of running a modern restaurant.

Since founding the Texas-based online ordering and contactless payment provider in 2017, he’s been focused on creating a tech stack that is tailored to helping casual-dining restaurants operate with less labor without sacrificing the guest experience. This focus came after many supporting examples that he said prove POS isn’t equipped to undergird today’s multi-channel environment.

Krupp’s top-line concern is creating enough tech-based efficiency that restaurants don’t need to take price. On his self-proclaimed mission to optimize casual dining, his focus includes dethroning the almighty POS platforms along the way.

It only takes a quick look around restaurant LinkedIn to realize his point of view is one that’s widely debated across the industry, as loyalty, delivery marketplaces, advance drive-thru technology and so many aspects of the business depend upon connecting disparate systems dependent on what’s commonly called “a single source of truth” for critical payment, loyalty and kitchen performance data.

“We believe that casual dining should run 30-plus percent of EBITDA (earnings before interest, taxes, depreciation and amortization) not by taking price, just by optimization,” he said. “We’ve now proven that through multiple brands that it’s do-able, so we’re on a mission of fixing casual dining.”

Beware the flip

For Krupp, this moment feels less like the golden age for a restaurant technologist, and more like a gathering storm where new business models could mean delivered food could soon become cheaper than the cost of dining inside a traditional restaurant.

For Krupp, this moment feels less like the golden age for a restaurant technologist, and more like a gathering storm where new business models could mean delivered food could soon become cheaper than the cost of dining inside a traditional restaurant.

“It’s about to flip,” he said of restaurants adjusting pricing due to inflation and other macro challenges. “As we keep taking price, what we’re not noticing is that we’re making dining out the premium instead of [making] delivery a premium.”

Boiled down for somebody less attuned to the nuance of tech stack 202, he feels new, leaner estate formats like ghost kitchens and virtual restaurants could give newcomers or existing delivery marketplaces the perfect opportunity to compete on quality and price at the expense of restaurants still relying partially on dine-in traffic.

“If the industry doesn’t understand how to redo its unit economics … casual dining will be the first victim of losing enough customer base that they can’t afford the real estate,” he said. “If you can’t afford the real estate, then you’re going to be a delivery company working out of a warehouse.”

Rather than trying to raise prices or reduce costs wherever possible, his view is that technology optimization can provide enough of a lift to overcome these fundamental challenges, which he said include delivery marketplaces directly competing with restaurants through their own virtual restaurant brands.

It’s all a long way toward making a case that pricing decisions are just one symptom of the restaurant industry building too many add-ons to a structure built upon and around the POS, and making too many decisions without what he calls fundamental data science.

In his view, casual restaurants have approximately 24 months to retain customers and improve efficiency, before business models with lower structural costs begin to significantly erode market share. His perspective might sound intentionally incendiary, but he believes this ongoing situation could create an industry-wide disruption that could rival the pandemic.

“They have to suffer and then they find you, right?” Krupp said. “I’m a big advocate of making this industry a better place, but it’s its own worst enemy.”

A fundamental shift

With functions like loyalty, marketing, order integration and many others pulling key data from the POS, OneDine’s perspective is of an industry building castles out of Band-Aids, forcing compromises and workarounds that are ultimately unhelpful to restaurants with a dire need to improve overall efficiency.

With functions like loyalty, marketing, order integration and many others pulling key data from the POS, OneDine’s perspective is of an industry building castles out of Band-Aids, forcing compromises and workarounds that are ultimately unhelpful to restaurants with a dire need to improve overall efficiency.

To further illustrate the point, he uses the example of a POS not knowing what’s happening on the make-line’s grill—and how that blind spot can trickle through other operational areas, like order throttling.

“Today, your tech stack is not conscious of that, so it relies on either preset algorithms or a real-time manager throttling the business, and neither one is optimal in management and neither one is optimal in maximizing revenues,” he said. “What you end up having is a lot of effort for less revenue. The end result of it is always less money … more overhead with less money.”

Krupp has bachelor’s and master’s degrees in economics, and he pays close attention to household income, inflation and the cost of food, whether that’s groceries, delivery or dining out. He points to Wow Bao as the perfect example of a lower-cost model that’s finding success, but added that convention centers and underutilized hotel kitchens could also contribute to upending sitdown restaurants.

“This is where we’re heading and here’s the reality: Uber Eats knows it and DoorDash knows it, and they’re building their own versions of that because they realize the restaurants won’t catch up, they don’t have the funding to catch up,” he added.

Asked how this point of view translates to OneDine’s feature set, he said everything his team does is about quality data, first and foremost, and addressing the root causes of key issues, rather than building workarounds dependent upon other, outdated systems.

Asked how this point of view translates to OneDine’s feature set, he said everything his team does is about quality data, first and foremost, and addressing the root causes of key issues, rather than building workarounds dependent upon other, outdated systems.

Krupp pointed to Bartaco CEO Scott Lawton as an executive that shares his point of view, and said his brand’s lower operating costs, enviable EBITDA and high employee salaries show that proper optimization can be game-changing for a restaurant.

“He doubled down, tripled down, he quadrupled down to drive the vision and, today, he probably has the healthiest P&L I’ve ever seen,” he said. “We talked, jokingly but half seriously, that he and I should write a book together on what it really takes to create transformation.”

Pressed for signs of a restaurant group making the wrong decision, Krupp pointed to CIOs and IT professionals that prioritize growing their own in-house team and budget, rather than creating a tech stack that inherently requires fewer experts at a brand’s headquarters.

“If you want to have a $10-million department budget, go to a technology company,” he added. “You work for a restaurant company, your job is to streamline and simplify, not build a perfect solution that you believe with whatever anecdotal data you have … we’re the anti of that.”

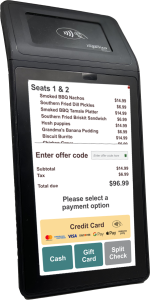

At a more practical level, Krupp said that the ongoing rise of loyalty programs can illustrate a telling example of POS being a poor fit for restaurants. If several individuals in the same party want to activate their loyalty rewards, he said that would often require a server to separate everyone into separate checks.

That type of work-around, he said, can be fine in the moment, but can then create issues by skewing aggregate sales data operators should be using to make important decisions.

“Everything you integrate has to live in the constraint of this square box called a check, so everybody’s building around a data model that’s so not the way we do business today,” Krupp said. “That forces them to create features that are very handicapped by what the POS can do, because they see the POS as the center of the world. We didn’t do that—we took a brand-new approach to the world.”