New market share data gives a little insight into who’s winning during the global COVID-19 pandemic. It may come as no surprise that U.S. delivery leader DoorDash is, so far, coming out on top.

In a new look at more than 190,000 transactions through April, Edison Trends showed off the recent market share snapshot. In essence, the trends continued a lot like they were before (as seen in May of 2019 and in February of 2020), perhaps magnified slightly by the pandemic. As more people tried delivery for the first time, they piled on to well-known brands.

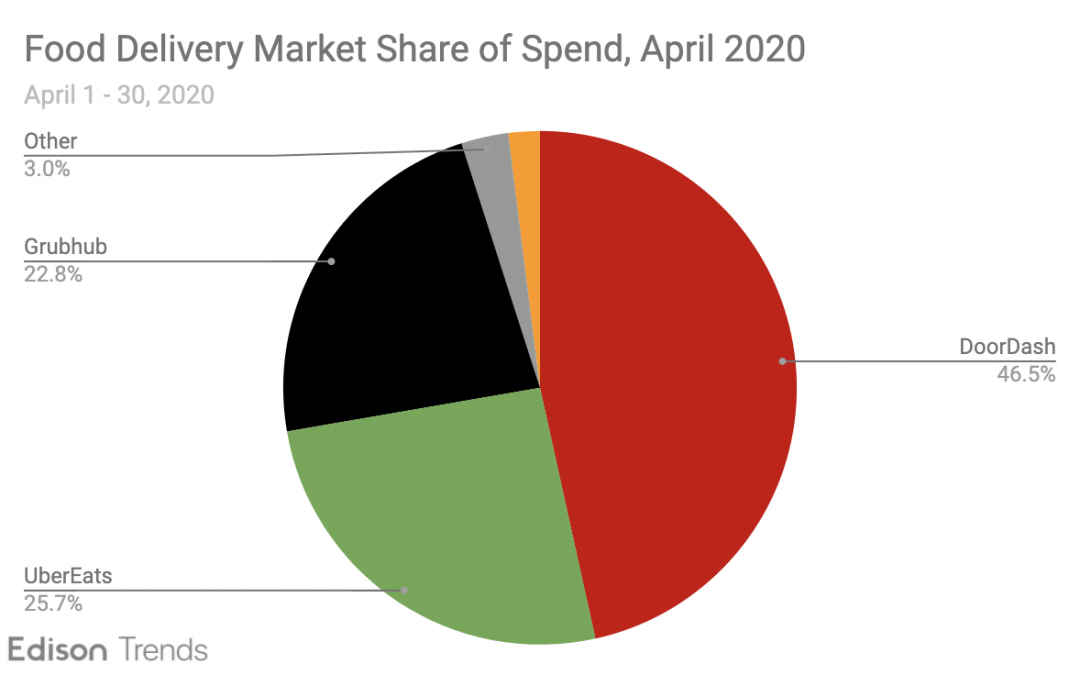

In the latest look, DoorDash retains the top spot with 46.5 percent market share. Uber is a distant second with 25.7 percent of the U.S. market and Grubhub right behind with 22.8 percent.

In context with Uber’s big news, the market share snapshot is especially intriguing. If Grubhub did roll into Uber’s operations, the combined company would have 48.5 percent of the market. It would also give Uber key markets like New York and Chicago, where Grub dominates, and a higher percentage of independent restaurants, which are more profitable than enterprise clients.

There are potential downsides lurking. First up is just getting the deal done, as Peter Saleh of financial research firm BTIG noted in a research briefing.

“We do not believe this potential acquisition of Grubhub by Uber, if true, would easily pass regulatory scrutiny. Given the significant market share a combined company would enjoy in the food delivery sector, we believe regulators would think twice,” wrote Saleh.

Even with combined forces, scale isn’t necessarily a panacea for the potential mega company.

“We believe this transaction is about driving scale by merging UberEats, a company with significant exposure to enterprise brands (chains) with Grubhub a brand with a strong legacy of service with independent operators,” Saleh said. “While we believe a merger would ultimately, reduce some of these overhead costs, we are unsure that it would be enough to reach profitability per order.”