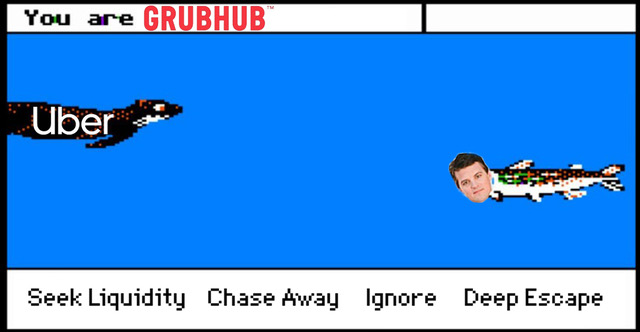

After hiring an advisor and considering a sale of the company back in January, Grubhub, the second-largest U.S. restaurant delivery provider, is said to be in talks with Uber, which has reportedly offered to acquire the Chicago-based company in an all-stock transaction. If the transaction goes through, the combined entity would be the largest food delivery player in the United States.

Originally reported by The Wall Street Journal, its report said Uber first approached Grubhub in February “with an all-stock takeover offer, and the companies have been in talks since then.” The Journal story said Grubhub was seeking 2.15 Uber shares for each Grubhub share in a potential cashless transaction.

The speculation comes six months after Uber CEO Dara Khosrowshahi said the company would seek to become the largest or second-largest delivery provider in cities it operates in or it would retreat from those markets following the company’s third-quarter 2019 results where it lost $1.2 billion, after losing a jaw-dropping $5.2 billion the previous quarter. Since then, Uber shuttered its Eats business in several international markets, including India, the Czech Republic, Saudi Arabia, Egypt, Honduras, Romania, Ukraine and Uruguay.

In its latest earnings call, days before the rumors started flying, Khosrowshahi dropped a possible hint by saying “there is a bunch of consolidation happening on a global basis where bigger players cannot only provide better service for restaurants and consumers, but can provide a better service kind of on an economic basis that is sustainable.”

Uber declined to comment on “rumor or speculation,” and Grubhub didn’t respond to a request for comment from Food On Demand. The news made headlines across the country as delivery has quickly become a much larger part of the North American restaurant scene during the COVID-19 pandemic.

Putting an ultra-fine point on the strained relationship between restaurants and Grubhub in recent years, Forbes’ story on the possible deal was notably direct: “Uber’s Grubhub Play: A Desperate Bid To Save A Business Everyone Hates.” Forbes noted that the offer could value Grubhub at $6.9 billion, “which would give Uber Eats 55 percent of the delivery market with the addition of 24 million active users.”

Bloomberg previously has valued Grubhub at $4.5 billion.

The investor community seemed to cheer the possible acquisition, with Grubhub’s stock rocketing up to nearly $65 per share, causing a temporary halt on trading due to increased volatility. Uber shares increased modestly, up to $34 per share, before settling back down into the lower 30s the next day.

Food On Demand reached out to a handful of experts for their take on the potential deal’s impact on the wider U.S. delivery scene. Fred LeFranc, a restaurant and delivery consultant with Results Thru Strategy said three key words have likely motivated both companies to entertain a possible transaction: money, competition and fear.

“Consolidation was inevitable given the losses many of the [third-party delivery brands] were experiencing,” he said. “We have seen this in other industries. The question is will scale help the lower commissions so that restaurants can actually profit from using their services.”

To help each company reach profits that have been elusive in the third-party delivery space, LeFranc said combining two of the largest players could bring additional opportunities in staffing of drivers, logistics and marketing.

Alex Canter, CEO and founder of Ordermark, said Uber having “way more drivers on the road” and Eats already having “the fastest third-party delivery platform” could result in better delivery speeds for restaurants in each network.

“Uber is already the fastest third-party platform, so Grubhub would probably get faster as a result,” Canter said. “Grubhub used to be the top player, and they’ve been losing market share consistently over the last few years. Uber is trying to get to No.1 or No.2 [position] in every city that they are in, and adding Grubhub’s market share will propel them ahead of others in some of the largest major cities, including New York and Chicago.”

Michael Schaefer, global lead of food and beverage at Euromonitor International, speculated that fewer, larger delivery providers could reduce expenses for those that remain, potentially improving the economics enough to result in profitability. He added this could also result in less pay for drivers and higher costs for restaurants.

“In addition to potentially reducing spend on subsidies to customers and driver incentives, it would also improve the remaining companies’ bargaining power with restaurants, who would have fewer options for third-party delivery—more players means more competition for restaurants, which drives commissions down,” Schaefer said. “With less competition, aggregators could potentially charge restaurants more, pay drivers less on average, and require fewer deals to retain customers.”

Zach Goldstein, CEO and founder of Thanx, has long been critical of national restaurant delivery providers, which he previously said have commoditized the restaurant industry “in much the same way Amazon eliminated entire categories of consumer product companies with the launch of Amazon Prime.” Reacting to the Uber-Grubhub news, he said consolidation is inevitable to improve the economics for restaurant operators and the delivery providers themselves.

“In many ways, they have to—in spite of brutal economics for restaurant operators, the industry is still not turning a profit as a whole,” Goldstein said. “Grub was the only player who had previously seen profitability and competition has driven them down to $0 [earnings per share]. So this news is not surprising, though a lot of big personalities and the little issue of price could still very much get in the way.”

In a report immediately after the speculation news broke, Cowen analyst Andrew Charles said, “We believe there is merit to a WSJ article reporting UBER has approached GRUB with a takeout offer. We note cost pressures that have surfaced for GRUB following the 3Q19 turning point in strategy that have only intensified since the pandemic began. We believe consolidation makes sense as scale and reduced competition can help ease cost pressures.”

A Grubhub spokesperson cited by Cowen said the company remains “squarely focused on delivering shareholder value,” but added “as we have consistently said, consolidation could make sense in our industry, and, like any responsible company, we are always looking at value-enhancing opportunities. That said, we remain confident in our current strategy and our recent initiatives to support restaurants in this challenging environment.”

In a similar report, Wells Fargo Senior Analyst Brian Fitzgerald said the company has long maintained that Uber is likely to play the role of consolidator in the U.S. delivery scene. Fitzgerald added that a “reduction of competition would reduce the degree of capital destruction in the meal delivery industry. At $68/share UBER would value GRUB at an [estimated valuation] of ~$6.5B, an amount significantly higher than new reports of previous meal delivery industry acquisitions and attempts.”

He said scrutiny of a possible deal was likely as more legislators and municipalities take aim at national delivery providers as restaurants have borne an outsized negative impact from statewide and nationwide lockdowns due to COVID-19, which has been magnified by commissions restaurants pay to delivery providers.

Third-party delivery has become more important than ever as the largest providers have spent vast sums of money to defend their turf, spur customer order frequency and promote partnerships with major national brands that seem to be more at peace with the economics of third-party delivery compared with smaller, independent restaurant operators.

Whether the Uber-Grub deal moves forward, M&A seems inevitable in the category as brands have struggled to deliver sustainable profits. DoorDash, in particular, has spent wildly on customer acquisition and discounted delivery promotions in recent years, powered by the seemingly endless pockets of its SoftBank backers.

If the end result is Uber and Grubhub, a DoorDash-Postmates arranged marriage or something altogether unexpected, it’s likely that further shake-ups are coming down within the U.S. restaurant delivery industry.