While the pandemic forced many restauranteurs into the digital space to survive, current data shows that the demand for digital ordering persists and remains a necessity for businesses.

Paytronix, a guest engagement platform, breaks down several online ordering trends in its 2023 Online-Ordering Report.

Digital orders today consistently make up 25-30 percent of all orders, as opposed to less than 10 percent in 2019—and those placing online orders are increasingly members of that brand’s loyalty program.

Mirroring last year’s report, takeout again trumps delivery in preferred methods by consumers, with about 60 percent choosing takeout over delivery. However, Paytronix found that delivery customers purchase more frequently than takeout customers.

First-party ordering advantages

Many brands are discovering the advantages of having first-party ordering as a channel alongside third-party. However, Paytronix adds that even if restaurants are successful at converting third-party to first-party delivery, third-party services play an important role in customer acquisition strategy.

“The digital-ordering channel is no longer just a way for a customer to place orders. It’s part of the ongoing conversation between the brand and guest. This is a key reason why brands must have their own first-party mobile app,” said Andrew Robbins, CEO of Paytronix.

Consumers ordering through first-party are more likely to become part of the brand’s loyalty program, order higher-value items more frequently and tip larger amounts. On average, the percent difference between loyalty membership of first-party and third-party ordering is about 35 percent, according to the report.

Direct guest communication

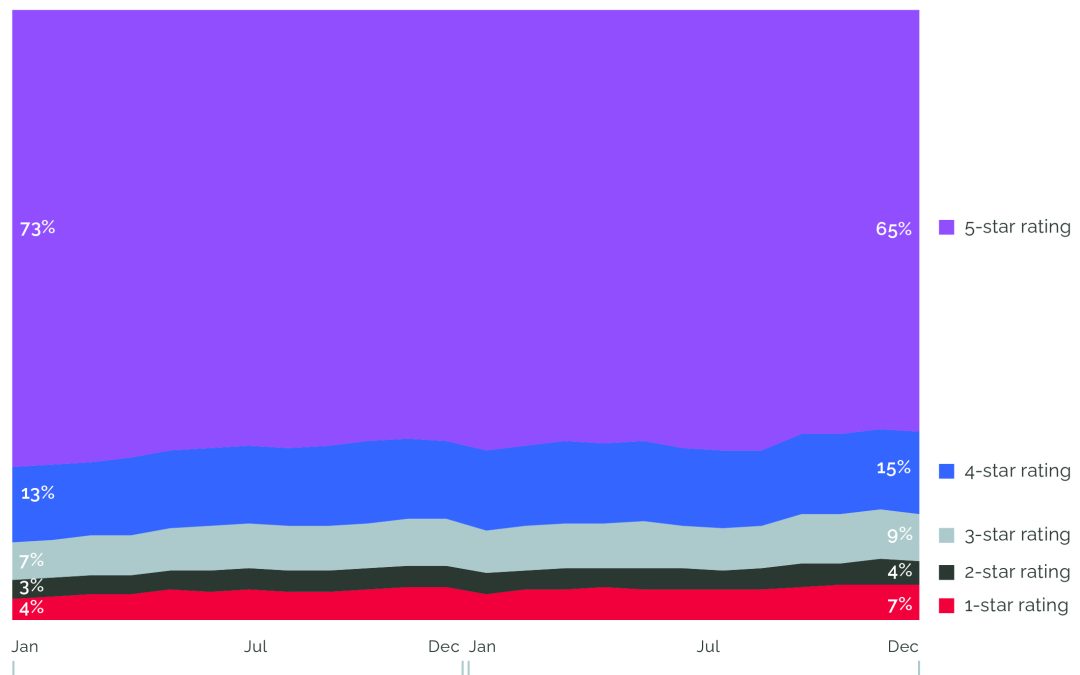

Among findings is also the need for brands to communicate directly with their digital guests. Brands saw a significant shift in customer behavior when reviewers received a response, even if the response was generated by AI.

“Our clients are finding that their most valuable digital customers are their most loyal, meaning that the entire guest engagement ecosystem needs to be in sync to achieve the greatest value,” said Robbins.

Restaurants that respond to a review typically see a 23 percent increase in orders and a 22 percent higher rating from guests.

Joanna O’Neill, managing partner of Johnny’s NY Style Pizza, a 64-unit franchised brand, experiences first-hand the benefit of transparent guest communication.

“When we hear directly from guests and respond to their complaints, we see a positive effect on our overall ratings. Within a year of starting that process, our online ratings went from high threes to high fours,” said O’Neill.

“People just want to be heard and responded to and to know that someone is listening.”

Other top findings include:

- While inflation pushes the prices of individual items up, guests are not decreasing basket sizes to compensate for higher prices. On average, item prices rose about 15 percent, while the average subtotal rose by 13 percent.

- Millennials and Gen Xers have stepped up as leaders in the online-ordering space, but it’s the Baby Boomers that appear to be the best tippers, leave higher ratings and return more often than other generations.