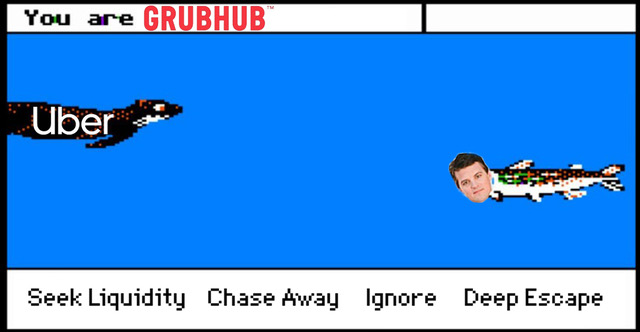

In the ongoing negotiations between Grubhub and Uber, it seems like only minor concessions remain between now and the signing table.

According to Bloomberg, “people familiar with the matter” say one key negotiating point remains: What’s known as a “breakup fee.” But in this case, it’s a reverse breakup fee where the acquiring company, Uber, would pay the target, Grubhub, a fee if the deal falls through. Typically this sort of fee is put into place only if an acquiring company backs out as a way to make good for the wasted time and effort on behalf of the target company. In this case, however, it would also cover any action by regulators that would keep the deal from going through—a chief concern as a merger of Uber and Grubhub would put the combined footprint of the companies at nearly 50 percent of the market.

According to people familiar with the matter, Uber is reluctant to agree to such a concession on top of the assumed $4.9 billion all-stock asking price. Uber, which had a market cap of $63.72 billion, is as reluctant to put cash on the table as Grubhub is eager to get such protection.

But if this is the only thing in the way of what would be the largest merger in the industry to date, it seems some big news is on the horizon.

Neither Uber or Grubhub responded to Food On Demand’s request for comment.