Researchers at Sense360 by Medallia dove into the latest food and beverage sales data to examine what COVID trends are no longer relevant in the context of a very different operating environment than two years ago. Amid ongoing instability from inflation and supply chain disruptions, its findings suggest foodservice is closer to 2019 levels of market stability, and that inflation is the new COVID in the minds of consumers.

As COVID concern levels have dropped since the rollout of vaccines in 2021, now only approximately 20 percent of respondents said the pandemic was their highest topic of concern. Instead, 49 percent of respondents said changing prices for the products they shop for is the biggest factor affecting household purchase decisions.

As COVID concern levels have dropped since the rollout of vaccines in 2021, now only approximately 20 percent of respondents said the pandemic was their highest topic of concern. Instead, 49 percent of respondents said changing prices for the products they shop for is the biggest factor affecting household purchase decisions.

While price has always rated highly in Sense360’s ongoing daily food diary research, a given store or restaurant having the best prices is now the highest concern for 49 percent of respondents, up from just 29 percent in August of 2021.

Having the closest location is still the top concern on consumers’ minds. Below prices, ranking second, the next-highest concerns were the availability of a loyalty or rewards program, followed by product availability and quality.

“Price has always been an important factor, it’s not like inflation brought this up out of nowhere,” said Andrew Custage, head of insights for Medallia Market Research. “Having the best prices has grown in importance, but it is important to recognize this is something that has always been a factor in consumers’ minds and is going to likely always be that way, even as inflation eventually subsides.”

Those same consumers said they were cutting expenditures (42 percent), avoiding eating out at restaurants (37 percent) and avoiding travel and leisure activities (23 percent).

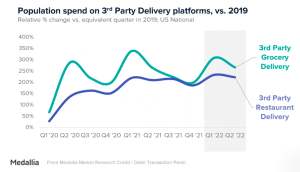

Zooming into third-party restaurant and grocery delivery, Sense360’s findings suggest that delivery volumes are holding steady, but that further growth in both categories is likely being stifled due to consumer resistance toward fees and tips.

Even with such sizable shifts in the economy, Custage said the proportion of transactions going to food/beverage-focused retailers versus restaurants has shifted over the last few years. As of the second quarter of 2022, 30 percent of U.S. transactions were going to restaurants, versus 70 percent going to retailers like convenience stores, dollar stores, drug stores and supermarkets—just one point lower compared with the first quarter of 2020.

Sense360’s study covered behavioral data, including customer loyalty in airlines, hotels, restaurants and retail, and also examined how many Chick-fil-A customers were “new” versus “lapsed” over the last 12 months.

As many restaurants and retailers have begun comparing recent sales to 2019 levels, to compare to a time before the pandemic, Custage recommended that comparing to 2019 numbers allows for trend comparison without seasonal irregularities. He added that, on the flip-side, comparing current metrics to 2019 compares to a period “that in some ways will never exist again, delaying the acknowledgement of a ‘new normal.’” There’s a lot more to the study, which is available at Sense360’s website.