Presto Automation has merged with shell company Ventoux to go public in one of the few successful SPAC deals in recent months, raising about $120 million from the public as well as a strategic investment from Cleveland Avenue and others and an infusion from Ventoux’s trust fund.

“We feel special, huh?” said Rajat Suri, Presto’s founder and CEO, referring to recently scuttled special purpose acquisition fund deals including Panera Bread’s. “We pulled it off because Presto’s solving a problem that’s getting more urgent by the day. There’s still 11 million jobs unfilled.”

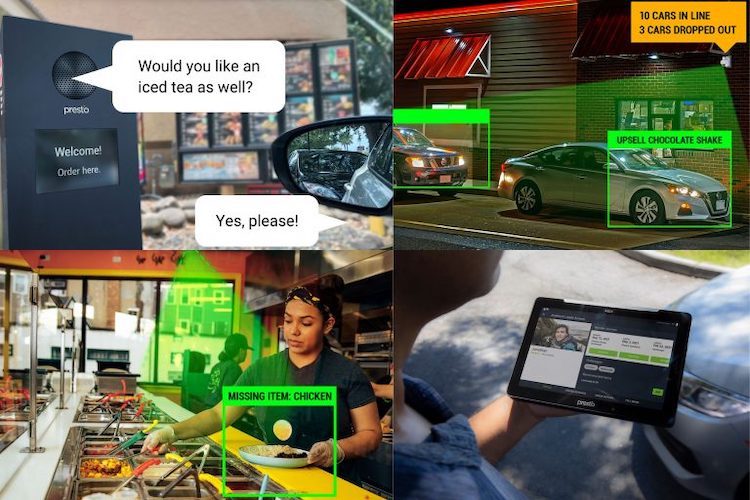

Presto develops automation technology for quick-service and casual dining restaurants and other hospitality clients, including artificial intelligence tools that speed drive-thru ordering, for instance, and allow employees to be deployed to other tasks. Presto will use its new capital to further invest in the space.

“The problem we saw is so urgent,” Suri said about the labor shortage. “We think entire restaurants will be able to be operated with one single person,” in the next few years. “You can go to restaurants in Japan, there’s only one person operating those restaurants. There’s a reason why a sushi conveyor belt comes from Japan,” because “they know how to automate.”

Checkers and Rally’s an early customer

Suri said the restaurant industry needs to change. “The industry in our country has been built on cheap labor,” and those days are gone. “Independents are really hit hard by the labor shortage…This is a trend that is really going to reshape the landscape dramatically.”

Presto’s voice artificial intelligence product, for example, “takes 95 percent of the orders in the drive-thru. For dining rooms, we help with taking orders at the table, with Presto Table. We do believe in the next two years, almost every drive-thru in the country will have some automation.”

Checkers and Rally’s was Presto’s first large restaurant chain rollout for voice AI, which CEO Frances Allen introduced to franchisees and planned to install in every corporate store by the end of 2022. “There’s a lot of questions about ROI and labor productivity,” Allen said about the AI technology, in an interview with FOD sister publication Franchise Times last January. “We believe it will be there, but it’s more about relieving strain and friction at the restaurant.”

‘No other way to go’

Suri said Presto has many other rollouts coming behind Checkers, which he cannot yet announce. “There’s tremendous interest. I would say almost every large” chain has some sort of strategy. “The industry is dramatically changing, and it has to because there’s no other way to go.”

Presto Automation is working on facilitating more personalization, speedier service and better analytics. “We’re working on multi-language support such as Spanish and other languages. Those are some of the areas we’re investing quite deeply.”

Ed Scheetz, CEO and chairman of Ventoux, the shell company that merged with Presto to take it public, said in a statement, “We remain committed to Presto’s mission of solving the labor crisis in the hospitality industry.”

Presto deal is rare success

Presto’s successful SPAC deal stands out as others foundered recently. One of the biggest promoters of the vehicle, “SPAC King” Chamath Palihapitiya wound down and returned cash to shareholders in two SPACs last week. The Wall Street Journal called the move evidence the market “has effectively shut down.”

In June, Panera Brands merger with Danny Meyer’s USHG Acquisition Corp., announced in November 2021, was called off. Meyer blamed “current capital market conditions” making it unlikely for an IPO for Panera in the near term.

Read more about the ups and downs of the SPAC market here.

Suri is also a co-founder of ride-share platform Lyft, which went public in March 2019 and raised $2.34 billion at $72 per share. This week LYFT is trading at about $14.50 a share.

Asked about Presto’s stock price, Suri said “I haven’t even checked,” because “we’re long-term investors. I’m not the type of guy to be refreshing the stock price” constantly. “Ask me in a couple of years. That’s more relevant.”

For those who are checking, PRST was $5 a share last week upon its Sept. 21 listing on Nasdaq, down from $10 a share pre-offering, and $2.33 per share yesterday.