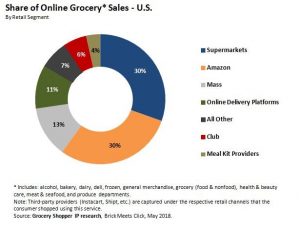

No other grocery provider even comes close to Amazon’s dominant position relative to online grocery retailing, according to a new report from Brick Meets Click’s latest consumer survey. The survey’s 4,855 respondents who participate in grocery shopping for the household show Amazon had captured 30 percent of online grocery spending in the U.S. by the start of summer this year.

In aggregate, the supermarket channel of the grocery industry captures about the same share of the online grocery sales market as Amazon. The Seattle-based retail giant has captured this leadership position by transforming how households shop for groceries over time by launching services like Subscribe & Save, AmazonFresh, Prime Pantry, Prime Now, and acquiring Quidsi and more recently Whole Foods.

Even with Amazon’s dominance, how consumers shop online for groceries with Amazon versus the Supermarket channel reveals improvement opportunities if it wants to maintain, let alone grow, market share.

According to Brick Meets Click research,

- Even though 77 percent of the households that are online buy products or services from Amazon, only 11 percent bought any groceries from it during the past 30 days.

- Households who buy groceries online from supermarkets turn to those retailers over 2 times per month as compared to 1.7 times for Amazon.

- The average grocery order for customers buying from Amazon is $45, which significantly trails what customers spend online at supermarkets ($116) or even online delivery platforms like Fresh Direct and Peapod ($143).

Source: Brick Meets Click

“Until recently, Amazon’s success relied heavily on leveraging its ability to overcome the physical constraints that the limit the reach and the breadth of assortment brick and mortar retailers can offer,” said David Bishop, partner at Brick Meets Click.

“To grow grocery market share, Amazon needs to strengthen its physical presence and persuade consumers to buy highly perishable products from it,” Bishop continued. “Whole Foods’ connection to Prime Now and exclusive Prime membership benefits will help to varying degrees, but more moves are clearly needed.”

Currently supermarkets do have an advantage: They outperform Amazon in terms of both purchase frequency and sales per order, according to the research. To protect their shopper base and attract more online trips, supermarkets will likely leverage these strengths—plus their physical locations—to make online grocery shopping even easier while also reinforcing the value of the in-store shopping experience.