BentoBox has released its 2021 Restaurant Trend Report showing how the restaurant delivery industry has evolved over the last year through the lens of its 7,500 restaurant partners. The findings point to rising operating and real estate costs, rapid ghost kitchen growth, a big drop in Friday lunchtime volumes and consumers shifting toward direct ordering channels.

Opening with the National Restaurant Association stat that 91 percent of restaurants paid more for food this year, while 84 percent paid more for labor and 63 percent spent more on real estate, the overarching story of the year—illuminated clearly in this study—is that restaurant owners had to react in several ways to stay profitable throughout the last 12 months.

Opening with the National Restaurant Association stat that 91 percent of restaurants paid more for food this year, while 84 percent paid more for labor and 63 percent spent more on real estate, the overarching story of the year—illuminated clearly in this study—is that restaurant owners had to react in several ways to stay profitable throughout the last 12 months.

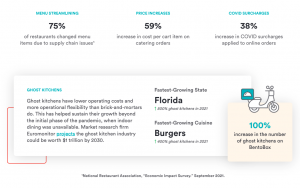

That first finding, that rising operating costs are forcing restaurants to find new efficiencies, was supported by 75 percent of BentoBox customers changing menu items due to supply chain issues. In addition, 59 percent of operators on the platform saw an increase in cost per cart item for catering orders, along with a 38 percent increase in COVID surcharges applied to online orders.

This bullet point included a breakout on ghost kitchens, which have become a much bigger deal throughout the pandemic. According to the NRA’s Economic Impact Survey, Florida saw the most new ghost kitchens, a 500 percent increase over 2020, and BentoBox saw a 100 percent increase in ghost kitchens on the platform during the year.

The second finding is that a “new normal” is emerging as people begin to emerge from their homes and re-enter the world, even though the pandemic continues. Respondents signaled that, from May through September of 2021, lunchtime revenues increased by 29 percent on Mondays, were up between 14 and 17 percent during the middle of the work week, and were down 8 percent on Fridays as it appears “the growing trend of hybrid work may continue to keep people home on Fridays.”

The second finding is that a “new normal” is emerging as people begin to emerge from their homes and re-enter the world, even though the pandemic continues. Respondents signaled that, from May through September of 2021, lunchtime revenues increased by 29 percent on Mondays, were up between 14 and 17 percent during the middle of the work week, and were down 8 percent on Fridays as it appears “the growing trend of hybrid work may continue to keep people home on Fridays.”

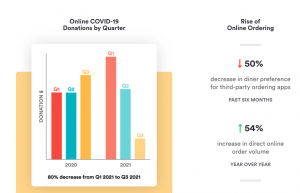

The study also found a 50 percent decrease in diner preference for third-party ordering apps over the last six months, with a 54 percent year-over-year increase in direct online order volumes as more restaurants and restaurant tech companies have rolled out more and better channels for consumers to order directly from restaurants.

Third, restaurant technology is slowly becoming less fragmented, according to the results. While this is undoubtedly colored by BentoBox itself being a restaurant technology provider, the company is seeing “a snowball effect [that] occurs when restaurants begin to leverage connected technologies.” This includes online ordering, event management, gift cards, and more, with Bento adding that the group of customers it labels as “super users” using multiple feature sets has grown substantially over the last 12 months.

Relatedly, restaurants are taking an increased ownership of online guest relationships, which is also directly tied to a proliferation of options and services in the restaurant tech landscape.

“In the last 12 months, BentoBox restaurants saved $38.5 million that would have otherwise gone to third-party apps,” the study read, related to commission fees saved through direct online ordering. That assumes a 30 percent commission fee on third-party ordering.

“In the last 12 months, BentoBox restaurants saved $38.5 million that would have otherwise gone to third-party apps,” the study read, related to commission fees saved through direct online ordering. That assumes a 30 percent commission fee on third-party ordering.

Lastly, the study highlighted that online ordering trends are reflecting a changing landscape, including the narrowing gap between online ordering volumes between the weekends and weekdays.

“The gap between weekends and weekdays shrunk considerably in 2021,” the report read. “Online ordering has become a routine part of peoples’ lives, rather than a ‘treat’ saved for weekends.”

Those shifting preferences have included a 187 percent increase in seafood delivery orders via BentoBox restaurant partners, as well as a 128 percent increase in bakery and a 112 percent increase in Mexican cuisine orders.

Visit 2021restaurants.com to peruse the interactive study for yourself, including the ability to check out the most ordered dishes by region.