Branch, a workforce payments platform that allows restaurants to go cashless and enable instant digital tips, raised $75 million through a Series C to extend its momentum in trucking, logistics, last-mile delivery in restaurants, while also expanding into the construction, hospitality and fitness industries.

The Minneapolis-based company’s funding round was led by Addition, with participation from equity investor General Atlantic and returning investors, Drive Capital, Crosscut Ventures and Indeed, among others. It plans to double its headcount, with all positions available to work remotely anywhere in the U.S.

The Minneapolis-based company’s funding round was led by Addition, with participation from equity investor General Atlantic and returning investors, Drive Capital, Crosscut Ventures and Indeed, among others. It plans to double its headcount, with all positions available to work remotely anywhere in the U.S.

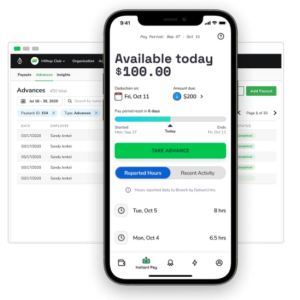

Branch’s offerings include instant, digital payouts of tips, wages, off-cycle, and contractor payments; free earned wage access; zero-fee banking; and an accessible paycard alternative. By partnering with Branch, companies can automate processes, reduce payroll costs, support workers with free financial services, and significantly decrease logistical burdens and cash flow concerns.

Its technology enables faster payments and provides inclusive financial services to W-2 and 1099 workforces for companies such as Uber Freight, Kelly, Walmart Spark, Flashtract and Tippy. The company was on Deloitte Technology’s Fast 500 list as one of the fastest growing companies in North America, with workforce payments platform revenue growing by more than 700 percent over the last year.

“Faster payments have played a pivotal role in our mission of helping working Americans grow financially, delivering tremendous value to so many people and industries,” said Branch CEO Atif Siddiqi. “With this new round, we have an incredible opportunity not only to accelerate payments in new sectors, but also provide additional cash flow benefits and tools to our customers.”

Building new tools for independent contractors growing their businesses, Branch is rolling out expense management cards with large enterprise customers including trucking and logistics companies. Branch also launched the ability to issue a business debit card and a cash back rewards program. Companies can add custom rewards for their employees and contractors to the program, as well.

“Branch is a proven, trusted solution serving some of the nation’s largest companies with faster workforce payments,” said Lee Fixel, founder of Addition. “We’re excited to support Atif and the team at Branch as they continue to scale the business and further cement themselves as the market leader in workforce payments.”

“Innovation in workforce payments is becoming more crucial as the relationship among corporates, workers, and end customers evolves and the working world emerges from the transformational last few years,” said Paul Stamas, managing director and global co-head of financial services at General Atlantic. “Branch is powering this shift, and we’re thrilled to support the company in its efforts to bring a new level of trust, reliability, and seamlessness to the space.”