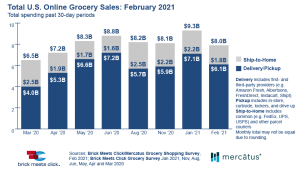

The ongoing growth streak in online grocery orders hit a bump in the aisle during February with sales dropping 14 percent compared to the previous month according to a joint consumer survey by Brick Meets Click and Mercatus.

The total U.S. online grocery market posted $8 billion in sales during February, which is a 14 percent drop from January’s $9.3 billion, as fewer households went online for groceries and placed fewer orders than in January, according to the survey fielded February 26-28, 2021. The survey is part of an ongoing and independent research initiative created and conducted by research firm Brick Meets Click and sponsored by Mercatus, an ecommerce platform for retailers.

The total U.S. online grocery market posted $8 billion in sales during February, which is a 14 percent drop from January’s $9.3 billion, as fewer households went online for groceries and placed fewer orders than in January, according to the survey fielded February 26-28, 2021. The survey is part of an ongoing and independent research initiative created and conducted by research firm Brick Meets Click and sponsored by Mercatus, an ecommerce platform for retailers.

“February’s overall sales contraction was expected,” explained David Bishop, partner at Brick Meets Click. “While January’s sales performance set a record high for online grocery sales, we also saw January’s shopper sentiment related to completing a grocery delivery or pickup order within the next month drop by approximately 10 percent, and that is what happened, albeit at a slightly higher rate, in February.”

The predominant driver of the February sales decline was the smaller base of households buying groceries online; monthly active users dropped 12 percent from 69.7 million in January to 60.1 million in February. Much of the reduction (more than 40 percent) came from the over-60 age group and may reflect growing confidence and/or personal preferences for in-store shopping as COVID-19 vaccinations rollout across the U.S.

Lower order frequency was also a factor in the sales decline with online grocery shoppers placing 6 percent fewer orders, averaging 2.7 orders during February compared to 2.8 during January. Most of the drop is attributable to the ship-to-home segment, which had a 12 percent decrease in order frequency. The combined delivery/pickup segment, however, was only down 4 percent on a month-over-month basis. As households become more familiar with the range of online grocery shopping options, their experiences are altering their expectations and perceptions about the value of shopping this way.

A 4 percent increase in average order value (AOV) on a month-over-month basis helped to offset the February declines in shopper base and order frequency. This increase in AOV was boosted by two factors. First is the continuing shift toward pickup and delivery, which typically involve larger orders. Households spent an average of $82 in February for orders received via delivery or pickup, which is 55 percent larger than orders shipped-to-home via common or contract carriers. The second factor is growth in both the respective AOVs for ship-to-home and delivery/pickup segments. The AOV for ship-to-home orders jumped nearly 11 percent, while the AOV for the delivery/pickup segment grew just over 1 percent in February vs. January.

As the market returned to the $8 billion level for February, the combined delivery/pickup segments captured $6.1 billion, accounting for more than three-quarters of the total online grocery market for the month. Within the combined segment, pickup’s share of online grocery sales grew once again, with share increasing over 5 percentage points in February versus January. As a result, pickup captured nearly half of all online grocery sales in February and grows in importance as it continues to capture a larger share of sales.

The leading indicator, “likelihood to use a specific service again,” stabilized in February as 58 percent of households reported being extremely/very likely to place another order with the same delivery or pickup service within the next 30 days.

While the overall satisfaction metric scores were essentially equal for both the pickup and delivery segments, the first-time user scores for each segment differed significantly. More than 40 percent of first-time, delivery-service users reported that they were extremely/very likely to use the same service again; in contrast, repeat intent scores for first-time pickup service users were more than 10 percentage points lower, landing below 30 percent.

“These scores are concerning as pickup is only becoming more vital to brick-and-mortar retailers for both strategic and economic reasons,” said Bishop.

“For many regional grocery chains, the online shopping battleground has shifted from delivery to curbside,” said Sylvain Perrier, president and CEO of Mercatus. “Lower repeat intent rates for first-time pickup customers puts the spotlight squarely on customer service. Implementing a frictionless curbside fulfillment experience that wins the customer the first time, every time will help grocers defend against mass merchants’ low-price advantage. Enhanced pickup services combined with retailer branded marketing strategies to win-back lapsed and lost customers can help increase monthly order frequency, and contribute to a healthy contribution margin from online shopping.”

A more extensive summary of the February 2021 research insights is available from Brick Meets Click.