A recent report by Bloomberg takes a closer look at what third-party providers are capturing market share and winning the third-party delivery war.

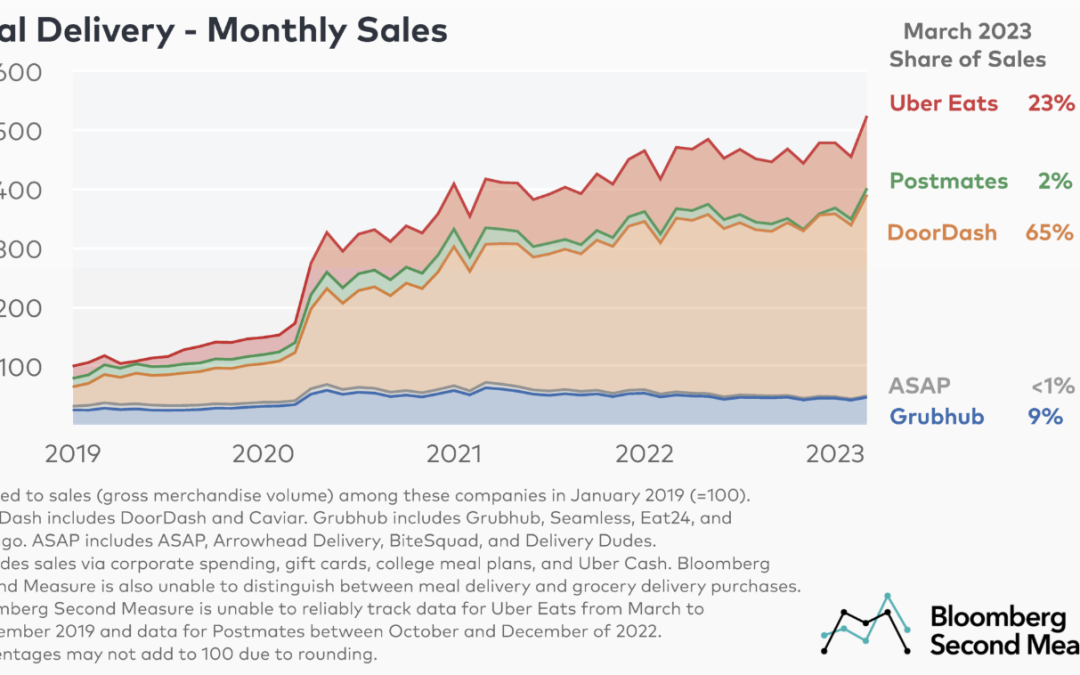

Looking at transaction data through March 2023, Bloomberg Second Measure finds that DoorDash and its subsidiary Caviar earned 65 percent of U.S. meal delivery sales. Between its debut in January 2019 through March 2023, the delivery company’s market share roughly doubled.

Uber Eats came in second place with 23 percent of sales. At the end of 2022, Uber acquired Postmates in an attempt to consolidate market share and boost profitability. Postmates earned 2 percent of U.S. meal delivery market in March 2023, which brings Uber’s market share up to 25 percent.

Meanwhile, Grubhub and its other third-party subsidiaries, Seamless, Eat24 and Tapingo rank in at 9 percent.

One of the industry’s smaller services, ASAP (known as Waitr prior to its rebrand in 2022) and its subsidiaries Bite Squad, Arrowhead Delivery and Delivery Dudes, earned less than 1 percent of national sales in March 2023. ASAP has been steadily transitioning to other delivery categories beyond meals.

Amid the highly competitive landscape, delivery companies continue to release incentives to attract and retain customers with various growth strategies.

Subscriptions such as DashPass and Uber One rein in as a top factor in maintaining customer loyalty. Bloomberg reports among subscribers who signed up for DashPass in March 2022, 69 percent remained subscribed after one month.

Delivery companies are also forming partnerships with the nation’s top chain restaurants. DoorDash and Uber Eats have signed deals with giants McDonald’s, Starbucks and more.

Other strategies include offering meal-kit delivery as well as prescription and grocery delivery. Uber Eats sealed the deal with Costco and DoorDash has partnered with Aldi—to name a few.

Despite the challenges faced by the current macroeconomic conditions with rising operational, food and gas costs and consumer’s scaling back on delivery, the market as a whole is expected to grow. Bloomberg data reveals that through March 2023, sales have grown 11 percent year-over-year.

Looking ahead, Bloomberg predicts the delivery battle to intensify, as diners today are not loyal to just one service. This could be attributed to more and more restaurants forming exclusive delivery partnerships and meal delivery services, with incentives like memberships and discounts attracting consumers from all angles.

Bloomberg analysis are based on debit and credit card purchases from a panel of millions of U.S. consumers.