As big-name restaurant tech players like Olo, Toast and Par grow their footprints and bring a raft of new features onto their platforms, loyalty and guest engagement provider Thanx sees an opening as one legacy brand shutters a portion of its business and a growing cohort of operators look for modern solutions that don’t require the cost and hassle of hardware upgrades.

While the biggest tech players expand their feature sets, Thanx founder and CEO Zach Goldstein says—like other restaurant tech founders—that some big-brand decision-makers are still prioritizing the largest tech platforms for fear that smaller vendors could disappear or be acquired in this funding-constrained period.

While the biggest tech players expand their feature sets, Thanx founder and CEO Zach Goldstein says—like other restaurant tech founders—that some big-brand decision-makers are still prioritizing the largest tech platforms for fear that smaller vendors could disappear or be acquired in this funding-constrained period.

Even with that operator hesitance, Thanx is seeing an unusual amount of action in the category as it works to onboard “hundreds” of new locations partially due to Grubhub “sunsetting” a portion of its LevelUp business that it acquired in 2018.

As the landscape shifts, Goldstein worries that, even as almost all restaurants have learned about the benefits of modern loyalty and engagement programs, many have taken their eyes off who is collecting their customer data and how it could be used over the long term.

“What we see happening is a little bit of the industry maturing as you finally get some players that have some heft that are looking to solve problems for restaurants,” he added. “There is a dark side that other industries have seen, which is that the more beholden you are to a single provider, the less they have to do on innovation, the less competition they have, the more [data] lock-in they have, et cetera.”

Eyes on the data

Earlier this year, Grubhub told impacted customers that it was shutting down a portion of LevelUp that served enterprise-grade restaurants. While the Chicago-based delivery provider has been steadily moving away from the LevelUp brand name and bringing the bulk of its services over to the Grubhub Direct side of its business, its Grubhub Direct Enterprise piece that builds branded apps and ordering channels for large-scale restaurants was being jettisoned.

LevelUp’s restaurant marketplace integration onboarding, point-of-sale integration, loyalty and analytics functionality live on, as well as its branded channel, app and website development for smaller-scale restaurants.

LevelUp’s restaurant marketplace integration onboarding, point-of-sale integration, loyalty and analytics functionality live on, as well as its branded channel, app and website development for smaller-scale restaurants.

Grubhub declined to offer specifics about the change, but Goldstein said Thanx first started hearing from restaurants impacted by the LevelUp change earlier this summer, which Goldstein said “sent a number of them into a tizzy.”

The 12-year-old company says it has signed approximately 10 former LevelUp clients during the last quarter. In response, Thanx has moved quickly to whittle its transition time down to approximately 60 days, which the company said is making it easier to directly appeal to restaurants that have used LevelUp for a portion of their digital businesses.

Goldstein said it’s unusual to see a restaurant tech player shutter a portion of its business, but added that it’s an opportunity for brands to move to a “less discount-oriented platform” and “force the issue” in terms of aligning their business goals with their customer relationship management tactics.

“It’s a bit of a chicken-and-egg problem in the restaurant industry, because the result of that [hesitant] mentality is that you’re stuck on legacy platforms that aren’t working because you’re afraid to switch,” he said. “And yet, the irony of it is that’s not a very good predictor of who’s likely to deliver you the best business results and be the best partner. One way that restaurants will become more comfortable with this risk is once they do a couple of these transitions and see that it’s not that hard.”

As he has highlighted for years across the industry, Goldsten added that brands should prioritize collecting and keeping their own customer data, rather than allowing large delivery providers and tech platforms to collect and silo a brand’s most crucial data.

Prioritizing exclusive experiences

Compared to a few years ago, most restaurants now know about the primary tools in the loyalty and CRM categories that have propelled brands like McDonald’s, Chipotle, Chick-fil-A, Sweetgreen and others to the forefront of the industry—by increasing frequency and maximizing customer lifetime value.

At the same time, many in the industry have started beyond discounts as the primary tactic to achieving these ends—partially in reaction to inflationary pressures all brands face, but also because many in the industry have begun prioritizing exclusive experiences and insider access.

Goldstein pointed to recent news that DoorDash is testing out rewards for customers that dine inside a restaurant, rather than order delivery, which he called a thinly disguised play for even more of a restaurant’s customer data. He called it the latest “escalation” in an ongoing battle between restaurants and third-party providers.

‘That’s a pretty naked approach to, ‘We just want your data,’” he said. “There’s no other interpretation of that, and that to me is a sign that the battle is still in early innings.”

‘That’s a pretty naked approach to, ‘We just want your data,’” he said. “There’s no other interpretation of that, and that to me is a sign that the battle is still in early innings.”

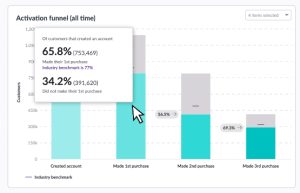

For operators reexamining their loyalty and customer engagement priorities, Goldstein said brands must avoid prioritizing metrics that he said are designed to make loyalty and CRM products look more successful than they actually are.

“If restaurants keep looking at vanity metrics while DoorDash keeps innovating on the ways to drive lifetime value, we already know how that battle will shake out at the end of the day—and to me that’s very concerning,” Goldstein added. “It’s doing a massive disservice to the longevity of restaurants as we know them to just pat ourselves on the back, for a provider who sells to restaurants to pat themselves on the back for metrics that can only go up.”

Pressed for examples, Goldstein said loyalty programs continually grow subscriber counts by definition. He called tracking sign-up growth a “useless metric,” and one that overlooks revenue growth, visit frequency and overall profitability.

Basket abandonment is another example, which Thanx estimates can recapture five to 20 percent of lost revenue just by asking customers if they’d like to continue a previously abandoned shopping cart.

His larger point was that loyalty and engagement platforms could be used to solve specific trouble spots in a restaurant.

“The leaders are all innovating when it comes to their CRM and loyalty program, and it’s because they just define loyalty differently,” Goldstein said about especially innovative brands. “Loyalty is about driving repeat frequency and lifetime value, and it’s about delivering personal experiences and convenience, not just a basic rewards program.”

Looking back to pandemic-clouded days, Goldstein said his sales team is doing “shockingly very little” education now that so many restaurants have expanded their understanding of loyalty and engagement efforts.

“Restaurants aren’t running unsophisticated programs because they think it’s the best thing in the world, they’re running unsophisticated programs because it’s the best option they have in front of them,” he added. “And that’s what their technology supports.”