DoorDash has released a new report indicating shifts in how consumers are purchasing consumables (non-restaurant items) such as grocery, household, personal care, pet care, and alcohol products.

The third-party delivery giant surveyed over 1,200 U.S. customers in August 2023 who made at least one consumable purchase in the last 30 days. The survey found that the introduction of quick commerce—an emerging channel within digital commerce where shoppers can purchase consumable items for on-demand delivery—has led to a change in last-minute household needs, a consumer desire for faster delivery of consumables and a different path-to-purchase.

Of those surveyed, 62 percent are ordering consumables online more than they did last year. Even further, 81 percent of respondents are purchasing consumables via a third-party app or website like DoorDash, search engines, or review sites in the past month.

According to the report, groceries are the most popular category of consumables to order online through delivery platforms or directly from brands, followed by household items.

“With more than 100,000 non-restaurant stores across our marketplace and Drive platform, 99 percent of U.S. DoorDash consumers now have access to grocery, convenience, pet, flower, or alcohol retailers,” DoorDash wrote in a statement.

Need for speed, convenience, continues to drive orders

When shopping for consumables, 74 percent say convenience is their top priority, next is ease of use (48 percent) followed by speed (46 percent). According to DoorDash, the average time for delivery is around 33 minutes.

Consumers are also frequently adding impulse buys to their online orders. About 60 percent of those surveyed are “somewhat or very likely” to buy new products while browsing online last minute, 55 percent say spontaneous buys are driven by last-minute needs, and 45 percent do so to fulfill the desire to “treat themselves.”

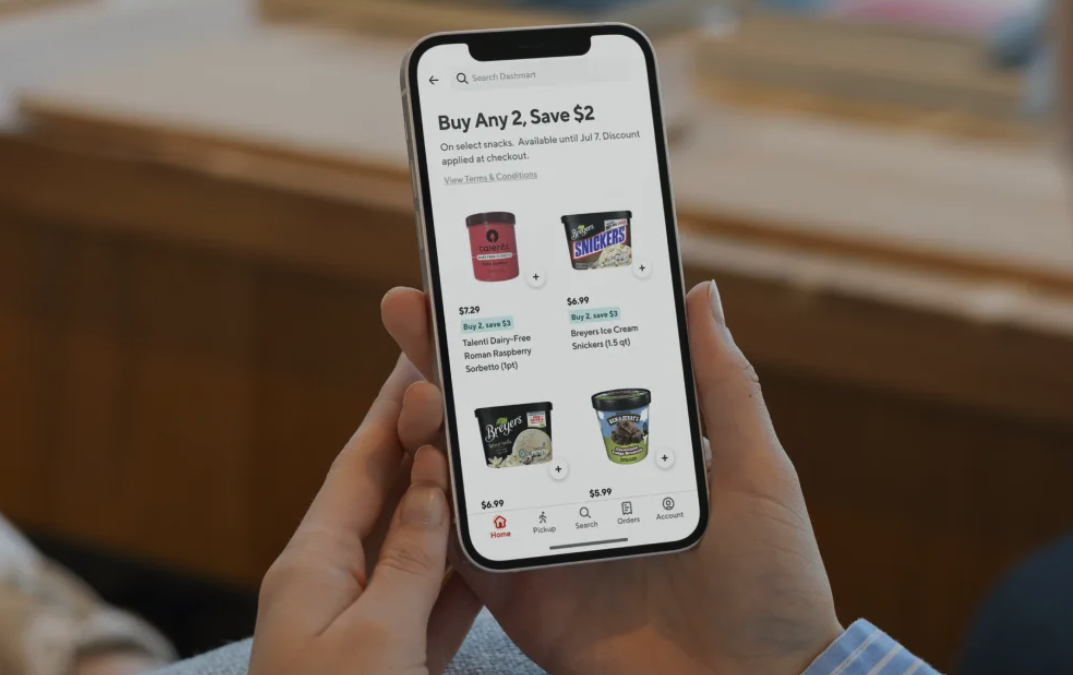

Third-party app use has also evolved, as consumers report being open to finding new brands through advertisements and promotions with the “expectation that marketing does not feel intrusive.”

“On-demand digital commerce is growing exponentially, and consumer shopping habits and expectations have shifted as a result of having nearly any product available for delivery within minutes,” said Toby Espinosa, vice president of ads at DoorDash. “But it’s not just how consumers shop that’s evolving. How they discover, interact and engage with brands has changed dramatically over the last few years, so brands and advertisers need to shift their approach, too.”

About 73 percent of DoorDash consumers surveyed who had purchased an ad or promotion in the past 30 days report that they did not think a promoted item in DoorDash felt like an advertisement.

“These insights make retail media network advertising fertile ground for reaching your target audience with relevant, engaging, non-interruptive advertising to build your brand and drive tangible sales,” said Kirk McDonald, North America CEO of GroupM, a media company that provided the foreword to the report.

In an effort to continue reaching new retail customers via its marketplace, DoorDash has updated its ad offerings for CPG brands, with new ad formats, deeper campaign insights, targeting and consumer-driven deal constructs.