Anyone in catering says nearly the same thing these days: group orders and workplace meal delivery are back and stronger than ever. The latest player joining this growing category is Meal Outpost, founded by two early Kitchen United employees.

Based in Chicago and roughly comparable to more established catering platforms like ezCater and Sharebite, Meal Outpost has grown primarily along the East Coast and in markets where the daytime office population has recovered.

Trying to avoid missteps they’ve seen in some corners of the ghost kitchen and virtual brand spaces, Meal Outpost delivers most of the orders that come through its marketplace rather than relying on third-party providers. Its rapidly evolving technology back-end has simplified the ordering process for office managers and employees, allowing large-scale employers to offer food as a back-to-office perk without the expense and complexity of operating an on-campus restaurant or cafeteria.

As relatively early employees of Kitchen United, founders Dustin Mares and Christopher Washington bootstrapped the company’s first phase. With some significant growth now under their belts, they are preparing for additional scaling and outside investments in 2024, which they expect will be the most significant year in the fledgling company’s short history.

Flexible adaptation

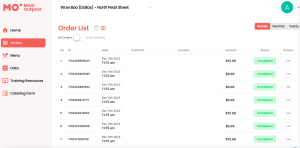

Meal Outpost’s catering partner portal

During three years at Kitchen United focused on member and enterprise partnerships, Mares said that experience working with some of the largest brands in the U.S., from Wingstop to Jersey Mike’s, Panera, PF. Chang’s and McDonald’s, was the perfect foundation to build something focused on workplace meal delivery.

As the industry evolved, and ghost kitchen players like Kitchen United and CloudKitchens tweaked their original business models and Mares—like other industry watchers—felt that vertically integrated ghost kitchens were better than ones that brought in a hodgepodge of restaurant operators.

In this setting, many small, independent operators discovered the costs and time demands of delivery-only kitchens weren’t profitable. Instead, he said, it became clear that ghost kitchens could thrive with an in-house portfolio of attractive brands, or with large restaurant companies that had the manpower to dedicate to ghost kitchens.

Meal Outpost co-founder Dustin Mares

He feels that the same logic applies to the catering space. While Meal Outpost has no real estate component with its model, its founders feel its combination of large national brands, mid-market restaurant concepts and delivery-only virtual brands are all complementary to the predictable volume and simpler fulfillment logistics compared to individual meal delivery using third-party marketplaces.

“One of the things that we saw as missing inside of the ghost kitchen space was a focus on catering,” Mares said. “A lot of those small…operators don’t have a director of catering, so that’s just another thing that they have to try and take care of.”

Asked what sets Meal Outpost apart from its larger competitors, Mares pointed to “flexibility in adapting to customer needs without compromising restaurant operators.” To clarify, he added that restaurants are often asked to make adjustments and changes for catering orders and feels “it shouldn’t have to be that way.”

He also underscored his family’s long history of operating catering-focused delis that showed him the economic possibilities for operators, along with the potential for landing a big client like a university or government contract.

Meal Outpost works with several virtual restaurant brands, and that model is also a good fit for such concepts that don’t have dedicated real estate or the customer recognition of even mid-market restaurants.

“All it really takes is maybe two or three larger, $700-$800 orders in a month to effectively reach that [profitability] threshold that most of the better virtual brands were already performing on third-party platforms,” he added.

While sharpening the company’s list of ideal restaurant catering partners, Mares said his team has turned down countless potential restaurant partners. That careful focus, he added, has partially led the company to the optimistic place it currently inhabits.

Growing around its anchors

With significant contracts with Walmart, Aramark, PwC and other large-scale employers, Meal Outpost also received its government license that’s beginning to unlock countless possibilities. Mares said there’s significantly more demand among government clients than his company could hope to service, suggesting significant growth in the near future.

With significant contracts with Walmart, Aramark, PwC and other large-scale employers, Meal Outpost also received its government license that’s beginning to unlock countless possibilities. Mares said there’s significantly more demand among government clients than his company could hope to service, suggesting significant growth in the near future.

Its first government contract involved a 10-month RFP process, but was ultimately worth the effort. It will begin with 1,000 catered meals per week. Meal Outpost currently has at least eight additional government-sourced contracts in its pipeline.

The company also works with massive restaurant groups like TGI Fridays, which includes Krispy Rice, a C3-sourced virtual brand, and Wow Bao—largely viewed as one of the most successful virtual concepts in North America.

“The Sweetgreens and Cavas of the world, [to] the small local brands, those are the types of brands that we aim to work with and be able to put in front of the employees that are ultimately ordering,” Mares said.

For all restaurants on the platform, Meal Outpost stresses simplicity, especially in recommending restaurants only put a portion of their menu due to the more repetitive customer behavior in workplace settings. That makes it easier on the kitchen, and also simplifies the ordering process.

At present, New York City is Meal Outpost’s most significant market, where Mares said “everybody’s back to work.” For a typical 300- or 400-employee office, in-house cafeterias are largely a thing of the past, even though large employers still want the “best of both worlds” by continuing to use food as an employee benefit. That drive is why the company, and many of its competitors, make it easy for companies to subsidize employee meals.

As the company preps its internal infrastructure for further geographic expansion, Mares said his team is finding creative ways to use artificial intelligence to deliver an improving ordering experience, and developing its own technology to replace Square, as an example, with its own proprietary technology.

Meal Outpost co-founder Christopher Washington

The company does use outside fulfillment partners like Nash, but is handling its own order delivery as much as possible, with employees called “outpost coordinators.

Using its own drivers is a clear client benefit in places where security badges are required to enter the building.

“If the admin or someone else has got to come down 60 floors to get your food, then all of a sudden you’re 15 minutes late,” he added. “That can be pretty challenging in a 50- or 70-story building. You sometimes have to go to the 30th floor, get off that bank of elevators, and go to another elevator bank on the way up—and it happens all the time.”

After expanding its presence in Charlotte, its first market, along with New York and Dallas, Meal Outpost is expanding in Washington, D.C., and entering smaller cities like Okeechobee, Florida and Connecticut, all the way up to Los Angeles, the country’s second largest metro area.

“For us, it’s not like we’re going to go everywhere,” Mares added. “It’s more strategic on where our partners are and where they’re asking us to go. As long as there’s an anchor within a city, we can grow there.”