The catering and workplace delivery category is heating up as Lunchbox, an online ordering and marketing provider, takes a big step into the category by hiring catering expert and MonkeyMedia founder Erle Dardick as its chief strategy officer.

Dardick is the new chief strategy officer at Lunchbox.

Dardick is one of the best known names in restaurant and foodservice catering, who sold Monkey, a cloud-based platform for takeout, delivery and catering, to ezCater in 2019. With his new contract role at New York-based Lunchbox, he’s back in the category with what he called “the right project for me at the right time.”

Given his background in catering, along with Lunchbox’s purchase of enterprise ordering provider NovaDine in 2022, the restaurant tech startup is set to make a major splash as category giant ezCater prepares to go public.

Dardick is also the founder of the Off-Premises Growth Academy, which provides training and certification in off-premises channels for multi-unit restaurant and foodservice operators. During an interview with Food On Demand, he said his history of training and mentoring is an ideal fit for Lunchbox, a private company founded in 2019.

“We’re going to come in [to catering] hard and heavy,” he said. “We’re going enterprise, we’ve got resources and we’ve got a good investment group.”

He added that this new role will involve working with ezCater on the marketplace side of the business, but will also involve competing directly with his former employer and category leader.

“Bringing Erle on board is more than an exciting move; it’s a strategic alliance that will undoubtedly define the future of enterprise corporate catering,” said Lunchbox founder and CEO Nabeel Alamgir. “His deep understanding of the industry and our cutting-edge technology form an unbeatable powerhouse. We’ve been confronted with growing demand for our catering solution, and I can’t think of a better strategic partner than Erle to lead the charge.”

Leaning on lightness

Asked how this new offering fits in with the rest of the segment’s providers and adjacent players, including ezCater, Sharebite, Fooda and Foodsby, Dardick said Lunchbox’s offering is “lighter, faster and easier.” He added that the company intends to add additional features and functions down the road, but stressed that the core infrastructure is in place, and should appeal to a broad array of restaurant operations.

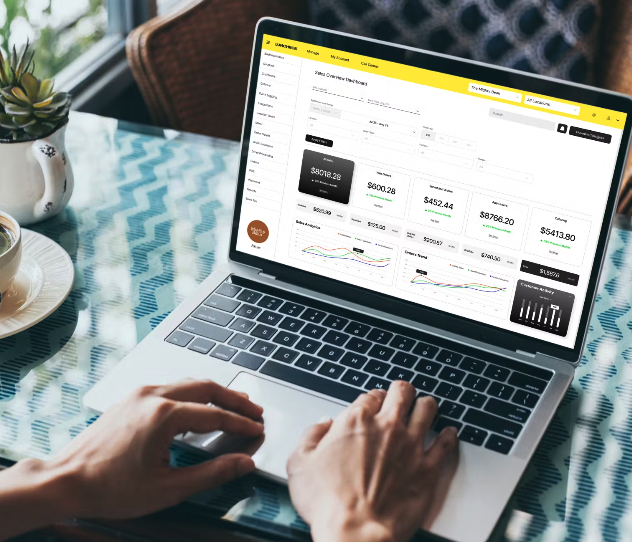

Lunchbox is betting its catering platform is a good balance of “lightness” and features.

“There’s a lot of work going on and it’s coming, it’s coming, it’s coming, it’s coming,” Dardick said of additional catering features in the pipeline. “I believe that the advantage for Lunchbox is that it’s a lighter solution, easier to put in, faster to train on—getting going is way quicker because it’s not as feature-rich and as heavy as the other ones, but it’s good enough from my perspective and as a best-practices tool.”

He stressed that including a customer takeout solution is a critical part of what he called a “winning formula” to compete with well funded, more established catering providers.

For its catering offering, Lunchbox promises order throttling, as well as seamless fulfillment, invoicing, reporting and guest relationship management. It also provides direct ordering, the ability to define standards for prep time, lead time and minimum order sizes, as well as features to help convert one-time guests into repeat clients.

According to a recent report by Technavio, the catering services category is estimated to grow by more than $100 million from 2020 to 2025, growing at a CAGR of 4.45 percent.

In a press release announcing Dardick’s hire, Lunchbox said enterprise-grade restaurants find “few trusted technology partners offering direct-ordering solutions,” which it said results in a significant gap between marketplaces and reliable first-party channels.

“With Dardick at the forefront of strategy, Lunchbox expects significant investment and development of its catering business, further positioning them to fill the catering order management gap,” the company said.

Ready to fight

On a tactical level, Dardick said he’s seen the language shift within the category, even though many aspects of a successful catering strategy remain the same.

Lunchbox founder and CEO Nabeel Alamgir

‘The strategy of menu differentiation is where we are in our history right now,” he said. “If you want to succeed with DoorDash menu parity, forget about it. That’s a ridiculous idea,” adding that restaurants need menus that are proprietary and tailored to specific sales channels, rather than offering an expansive menu through every different platform—from in-store to catering and direct-to-consumer delivery.

Dardick said Lunchbox acquiring NovaDine, a North Carolina-based provider of digital ordering management for restaurant chains, is a key component of its evolving platform.

“Nobody has takeout and catering in one place…because it’s complicated,” he said. “The workflow that is driving Lunchbox ordering is unique in its positioning in that it really is truly an order management system for takeout and catering, for pickup and delivery, with all the appropriate integrations that we’re running.”

From this point forward, Dardick will be a highly visible Lunchbox representative complementing its outspoken founder Alamgir.

“The headwinds are shifting, Dardick said. “What I mean by that is there was a time when ezCater and Monkey were standing alone in this category. Now you’ve got a whole bunch of solutions that are coming, so we might as well throw our hat into the ring, just go in and compete, and just bring a good solution forward to the market. Ultimately, everyone has to fight hard for the business.”