John Nelson understands the needs of convenience stories. His father owned a number of them, back in the manual-entry days. He saw how an e-commerce system could be helpful but a suitable one was hard to find. So he and his brother worked for three years to develop and pilot a product, something that would integrate into the tech stack of C-Stores. They launched Vroom Delivery in 2018. And now when he goes to trade shows many C-Store operators hug him hello.

John Nelson, CEO and founder of Vroom Delivery

The company initially focused on first-party ordering. “We built a tool so C-Stores could use ordering through their own apps and website,” Nelson said in an interview. “But as we grew over time our customers came us and said, You’re managing our menus so well on first party, but our third-party channels are a mess. Could you manage those as well? So a couple years ago we started managing third-party channels and now we do so for two-thirds of our retailers.”

Nelson’s tech savvy is certainly vroom vroom. If a C-Store has a screen of any kind, Vroom Delivery can automate it to process orders.

“We can manage all of a store’s digital assets,” he said. “If an order comes in through a phone or a first-party channel or through DoorDash or an in-store kiosk, we can manage the order.”

Nelson is finding plenty of operators happy to hand over its passcodes. Vroom Delivery currently works with more than 100 retail brands, which operates more than 6,000 stores. Not all of them offer fresh food but many do. “It provides their highest margin,” he said. “You make a lot more on food than you do on cigarettes or beer or snacks. It’s the highest growth area in the market right now.”

It’s also becoming one of the more complicated areas to manage right now, with all the ordering options an operator may use. Nelson explains a mind-bending scenario.

“If you’re a large truck stop, you may have multiple food vendors and multiple QSRs in the place,” he said. “You may have one centralized kiosk where you could place orders for different vendors. If you have a burger place, we can send the burger there, pizza to the pizza shop, coffee to the coffee shop. And it’s all tied together through a centralized order-management system. It doesn’t matter which channel it comes from, it all flows to the same place.”

H&S Energy reaps the benefits

H&S Energy operates 160 Extra Mile and Power Market C-Stores in California. It initiated its proprietary online ordering and delivery program with Vroom Delivery in 2021. The program is rapidly growing, surpassing $1 million in annual sales and now approaching $2 million. A key element is Vroom Delivery’s Automated Menu Management services, which enables the automatic listing of thousands of products online with minimal manual maintenance. This has led to a reduction in out-of-stocks to under 1 percent of orders. Going forward H&S Energy plans to expand third-party marketplace offerings and incorporate Vroom Delivery loyalty integrations.

H&S Energy operates 160 Extra Mile and Power Market C-Stores in California. It initiated its proprietary online ordering and delivery program with Vroom Delivery in 2021. The program is rapidly growing, surpassing $1 million in annual sales and now approaching $2 million. A key element is Vroom Delivery’s Automated Menu Management services, which enables the automatic listing of thousands of products online with minimal manual maintenance. This has led to a reduction in out-of-stocks to under 1 percent of orders. Going forward H&S Energy plans to expand third-party marketplace offerings and incorporate Vroom Delivery loyalty integrations.

Delivery continues to grow

Mirroring what’s happening in the QSR world, C-Stores are seeing steady growth with delivery, according to Nelson.

“Delivery is two or three times higher than pick-up for us,” he said. “We have partnerships with Uber and DoorDash. Many of our operators use their white label services, Uber Direct and DoorDash Drive, and we integrate with them.”

Nelson notes that C-Stores in rural areas often offer more robust food programs than their urban counterparts.

“You don’t see Casey’s in downtown Chicago offering pizza. But if you live in a small town where your only other pizza options is Domino’s or a Papa John’s, you see C-Stores. That’s where we’re seeing growth,” he said. “The more urban the C-Store location the smaller the food offering it often has.”

First party vs. third party

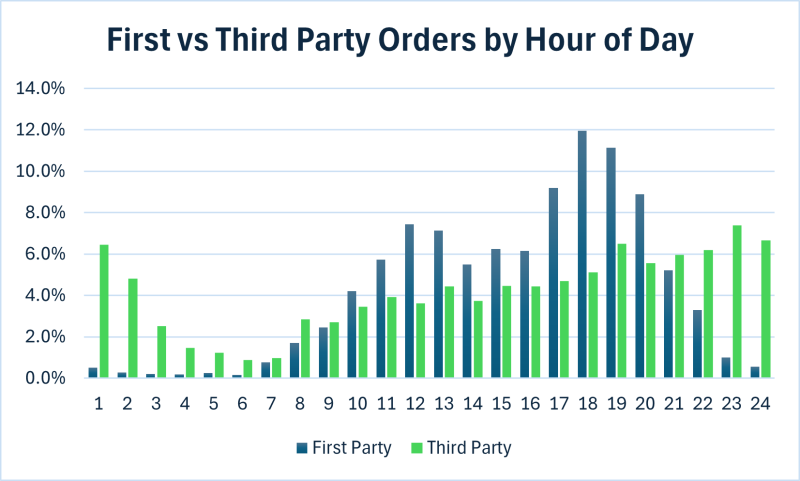

Nelson works with retailers on the data they receive. He helps them analyze and make promotional decisions based on what the numbers say. One of the areas he surfaces for them are the differences between first-party and third-party orders.

Nelson works with retailers on the data they receive. He helps them analyze and make promotional decisions based on what the numbers say. One of the areas he surfaces for them are the differences between first-party and third-party orders.

“The customers are different based on what they buy, when they buy, who they are, and how much they spend,” he said. “People use first party around dinner time but for late-night snacks it’s third party. Our average transaction on first party is $44 versus the average transaction on third rate is $18.”

A growth trajectory

Nelson and his brother are busy. ““We grew about two and a half times last year and we’re probably going to grow four to five times this year,” he said.

Their success may be in the simplicity of their pitch.

“We tell retailers to consider us a virtual point of sale,” he said. “We can do everything the in-store point-of-sale can do but we can do it for all the digital channels.”