Olo announced its fourth-quarter financial results, which showed the New York-based delivery integration provider narrowing its net loss and bringing slightly more revenue. The company highlighted its delivery partnership with Kroger and said active locations on its platform increased 10 percent year over year, to approximately 87,000.

Total revenues increased 25 percent year-over-year to $49.8 million, which improves on the previous quarter’s $47.3 million. Last time around, its net loss was $14.6 million, which decreased to a loss of $8.2 million during the latest quarter.

Total revenues increased 25 percent year-over-year to $49.8 million, which improves on the previous quarter’s $47.3 million. Last time around, its net loss was $14.6 million, which decreased to a loss of $8.2 million during the latest quarter.

Zooming out, Olo’s financial performance is less rosy, as its net loss increased significantly compared to this time last year, when Olo’s net loss was just $2.1 million, or one cent per share. That said, the company has $451.2 million in cash, cash equivalents and both short- and long-term investments as of December 31st.

Olo also purchased 2.7 million of its own shares, totaling $20.1 million, in an effort to boost its stock price. That effort was largely ineffective on a short-term basis, with its share price increasing from roughly $8/share to $8.47/share, however its share price has since fallen below $8.

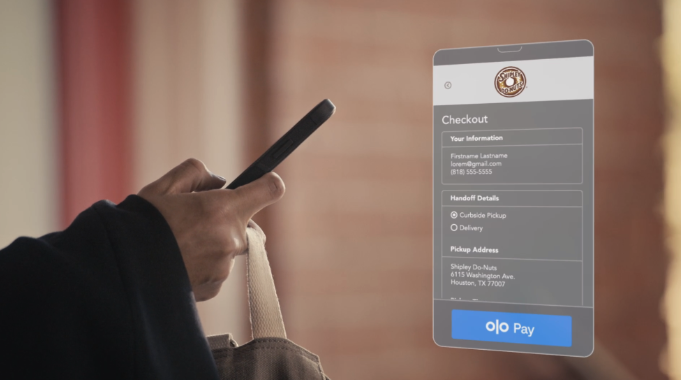

Olo highlighted its expanded relationships with existing customers, including TGI Fridays and Virtual Dining Concepts, which both deployed Olo Pay. The delivery infrastructure platform also added fast-casual seafood brand Captain D’s, which includes 550 new locations.

Olo also expanded its presence in the virtual brand category, including with Bloomin’ Brands’ Tender Shack virtual brand with more than 800 locations.

“In 2022, Olo increasingly became the platform that restaurant brands rely on to make their digital priorities a reality,” said Olo founder and CEO Noah Glass. “Now, more than ever, restaurants recognize the need to invest in technology as a means to better serve their guests and operate their businesses more effectively. Our hard work in 2022, our network of brands, partners, and guests, and our comprehensive product suite all enable Olo to meet the needs of our customers, and we believe have set the table for great things to come in 2023 and beyond,” he added.

“We have always been focused on balanced growth and efficient investment in the business. We believe this has served the business well over time and it is how we are approaching 2023. Our investment plan this year takes into account the rising cost of capital and the macro environment, which is reflected in the operating expense leverage we expect to gain in 2023,” said CFO Peter Benevides.