A new study of U.S. consumers shows an increased willingness to pay more to order delivered meals directly from restaurants versus third-party apps, possibly signaling heightened awareness of delivery economics in the eyes of the average consumer.

Simon-Kucher& Partners and research firm Lucid surveyed 647 U.S. consumers during the month of April and found that, on the whole, consumers expect to pay almost $2 more for the convenience of ordering delivery directly from restaurants, compared to what they expected to pay for delivery via third-party apps like DoorDash, Uber Eats and Grubhub in the months following city- and statewide lockdowns.

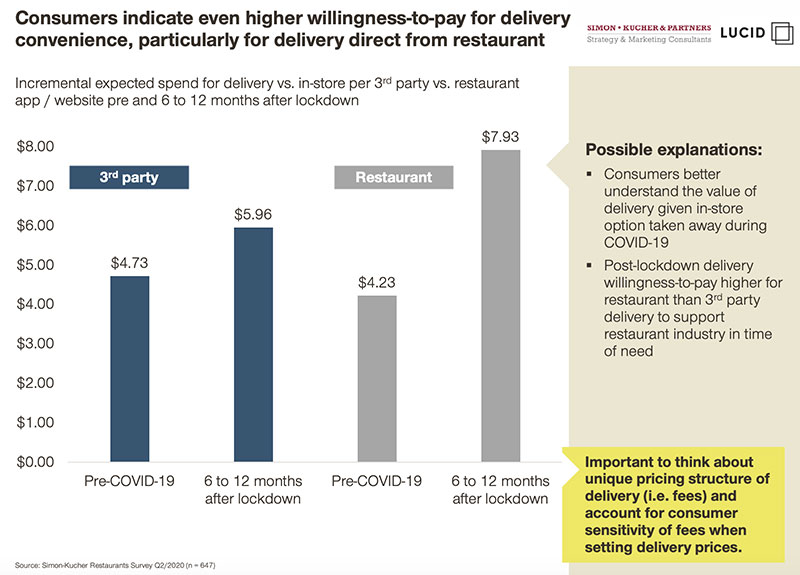

Prior to COVID-19, respondents said they expected to pay $4.73 for the convenience of delivery through third-party apps, which lines up with the common industry assumption that consumers have been generally willing to pay $5 for the convenience of delivery.

While the survey showed consumers expected to pay $5.96 to order delivery from third-party apps in the months after lockdowns, that increased to $7.93 for the convenience of ordering directly through a restaurant’s own channels.

The study’s findings aren’t iron-clad on why consumers feel that way, but the study’s authors surmised that variance could suggest consumers are now willing to pay more to order directly from restaurants in an effort to support the industry during a time of obvious need—a need which has garnered widespread media coverage during the pandemic.

Looking at U.S. consumers across a wide range of gender, age, income and geographic categories, its findings underscored other surveys that have shown consumers are looking for healthier options, and that they expect to order more meals through delivery and curbside pickup compared to the pre-COVID-19 era.

Included as a little nugget, the study also found that only 45 percent of consumers have ordered food via delivery, and that 70 percent of total delivery orders are coming through third-party platforms.

Predictably, sanitation standards rocketed up the list of criteria that’s important to delivery consumers, now taking a backseat only to the taste of the food and perceived food quality. Restaurant atmosphere, employee attitude and overall speed of service all were shown to be less important in the “new normal” era.

Looking at various ordering channels, including delivery, curbside pickup, drive-thru, in-store pickup and in-restaurant dining, just 23 percent of consumers said they expected to use drive-thru lanes to pick up meals after lockdowns, compared with 33 percent during the pandemic and 22 percent during pre-COVID times.

That’s especially notable as drive-thru service has been referenced as a key opportunity for restaurants with that functionality, and is commonly referenced in analyst reports and quarterly earnings calls.

Zooming out to their expectations for after the lockdowns have lifted, respondents said they expect to get 14 percent of their meals via delivery, 8 percent through curbside pickup, 23 percent through drive-thru lanes, 21 percent from in-store pickup and 35 percent from dining inside a restaurant—which is down from 40 percent pre-COVID-19.

Drive-thru preferences were more varied by age and urbanicity categories, with 29 percent of respondents 64 years and older saying they expected to frequent drive-thru lanes, versus 17 percent of those younger than 34 years of age. Younger consumers were more interested in in-store pickup and delivery service compared with older consumers.

While it’s somewhat shaky to derive many conclusions from such numbers, they suggest that some consumers are anxious to ditch drive-thrus and get back to more traditional restaurant experiences after the peak of the crisis.

Looking at the reasons consumers choose one delivery platform over another, younger respondents were more likely to choose an app based on promotional deals, while urban users were more likely to choose an app “randomly or based on a subscription.” Those with household incomes over $100,000 said time was their primary consideration in which delivery app they used.

There’s a lot more to the study including shifting market share between the third-party delivery providers, how each app rates on a wide range of metrics from order accuracy to customer support and service fees, as well as how purchase probability declines as delivery fees increase.

Click here to download the full report.