A new report by Deloitte paints a rosy picture of delivery’s effects in Europe. Titled “Delivering Growth,” Deloitte tapped into sales data, consumer surveys and public information to explore how the explosion of delivery has changed operations for European restaurants.

In short, the study concluded that delivery has been a net positive. Restaurants included in the study reported sales increasing after implementing Uber Eats, which paid for the study. According to Uber, the share of restaurants reporting an increase in sales was 59 percent in Madrid, 67 percent in Warsaw, 69 percent in London and 74 percent in Paris.

The majority of restaurants in the study saw incremental sales, though it’s a lot lower than the purely incremental lift many in the industry promised back in earlier days days. Restaurants with virtual kitchens added to the mix saw an even bigger lift than delivery, with such restaurants reporting a 50 percent sales increase.

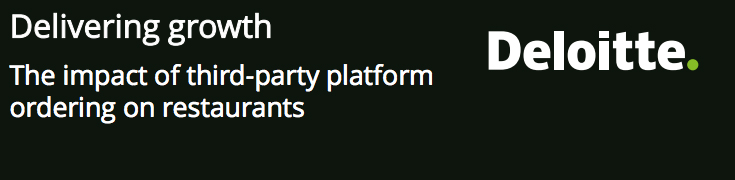

Of course, the big question is always about profits, and the survey showed with some confusing math that profits indeed increased in each of the surveyed markets, as seen in the graphic below.

The survey suggests profit margins within the revenue growth were 58 percent in London; 19 percent in Paris; a whopping 156 percent in Madrid and 41 percent in Warsaw. Margins like that are unbelievable, but the report authors attempted to explain what was going on in a footnote:

The greater increase in aggregate net impacts on profit relative to turnover in Madrid is driven by the relatively lower rate of substitution by meals ordered through third-party platforms for non-restaurant sector meals (see Figure 9). As a result of this, turnover increases from growth in the restaurant sector are more limited and counteracted by the decrease in turnover per meal due to substitution from on-premises dining to collection and delivery meals. Meanwhile, relatively more meals substitute lower-margin direct deliveries for higher-margin third-party deliveries, resulting in an overall larger net increase in total industry profits despite a not as significant net increase in turnover

By that logic, restaurants in Madrid saw an incredible level of incrementality and limited “turnover” from in-restaurant meals. The majority of delivery meals in Madrid replaced meals ordered from a restaurant according to a July 2019 survey by Deloitte. But hey, let’s not spend too much time on that consultancy math…

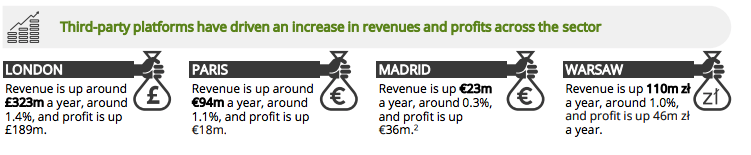

The full traffic effect was also pronounced, as seen in the graphic below.

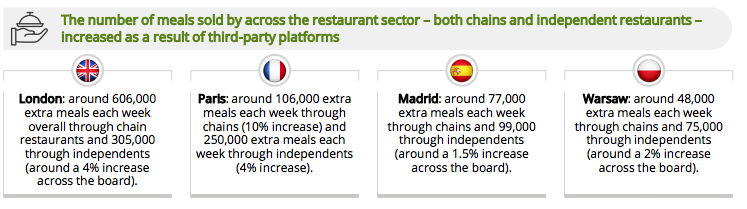

In all, that’s an additional 837,000 meals across the surveyed markets for chain restaurants and 729,000 for independent restaurants. That sort of growth suggests there is plenty more delivery expansion ahead in Europe. Deloitte predicted a huge portion of the foodservice world to be flowing through delivery by 2023, as seen in the graphic below.

“Food delivery is growing rapidly across Europe. Existing estimates suggest that the market is experiencing double-digit growth rates and could be worth $25 billion by 2023,” wrote the authors.

How does this all look in the U.S.? Well, that’s a lot harder to say, as the U.S. has a lot more restaurants per capita (too many if you ask most industry watchers), more competition among the platforms and a much higher rate of food eaten away from home. Uber did not respond to a request for comparative U.S. metrics.

Take a look at the full Delivering Growth report from Deloitte here for more statistics and results. https://www2.deloitte.com/uk/en/pages/financial-advisory/articles/delivering-growth.html